Over 650,000 real users* within 4 years

Multiple prestigious accolades won

Multiple prestigious accolades won

One of The World’s Best Banks 2023 by Forbes

Best Digital-only Bank in Hong Kong 2023 by The Asian Banker

Top rated* digital banking app for Hong Kong in Apple App Store

Protect yourself from bogus phone calls

Please be aware of bogus phone calls, fraudulent SMS messages, phishing websites and email purportedly from banks. Should you have any suspicion, please contact our Customer Care Team at +852 2888 8228 or report to the Police immediately. Please click here for more information.

Promotions

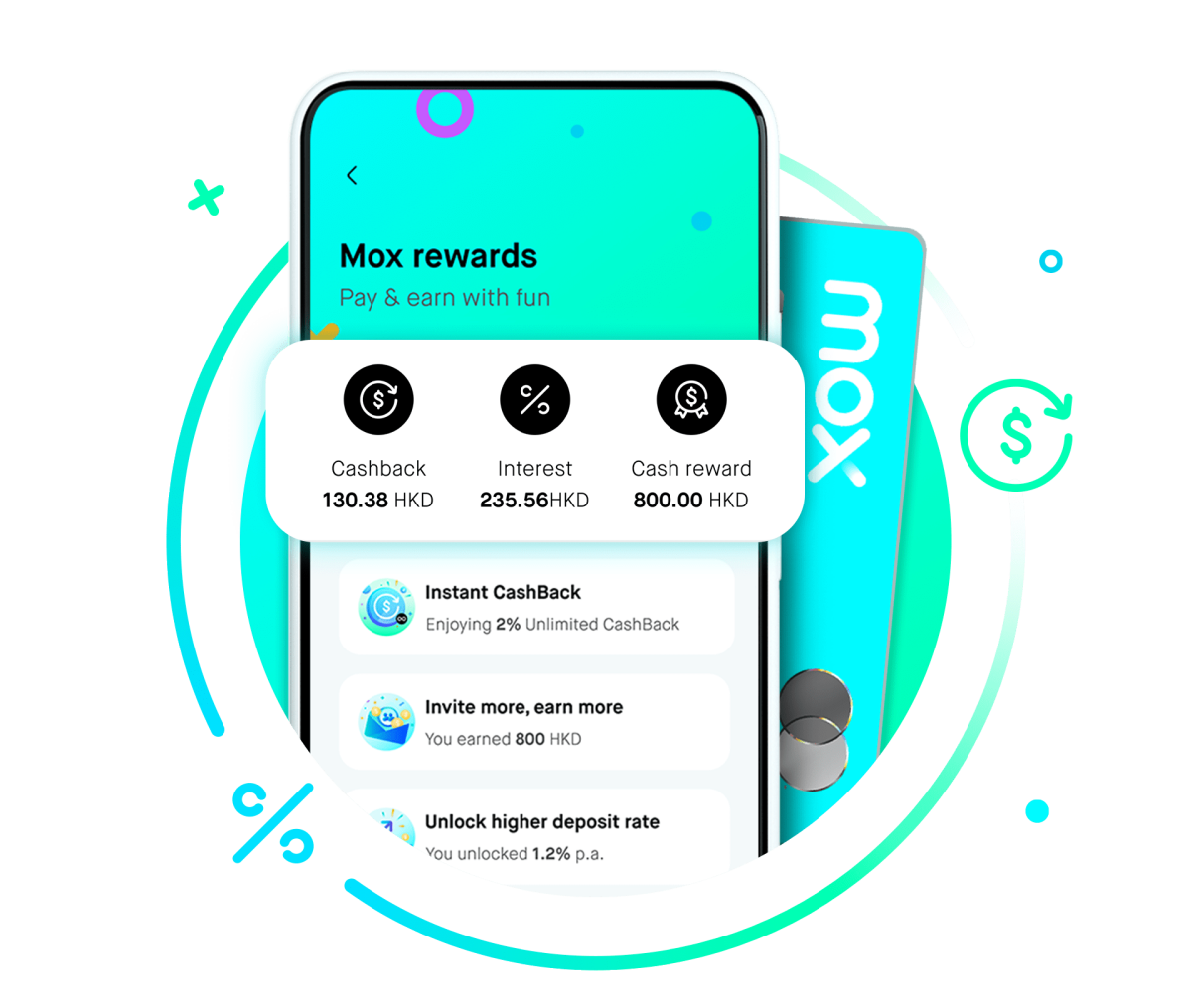

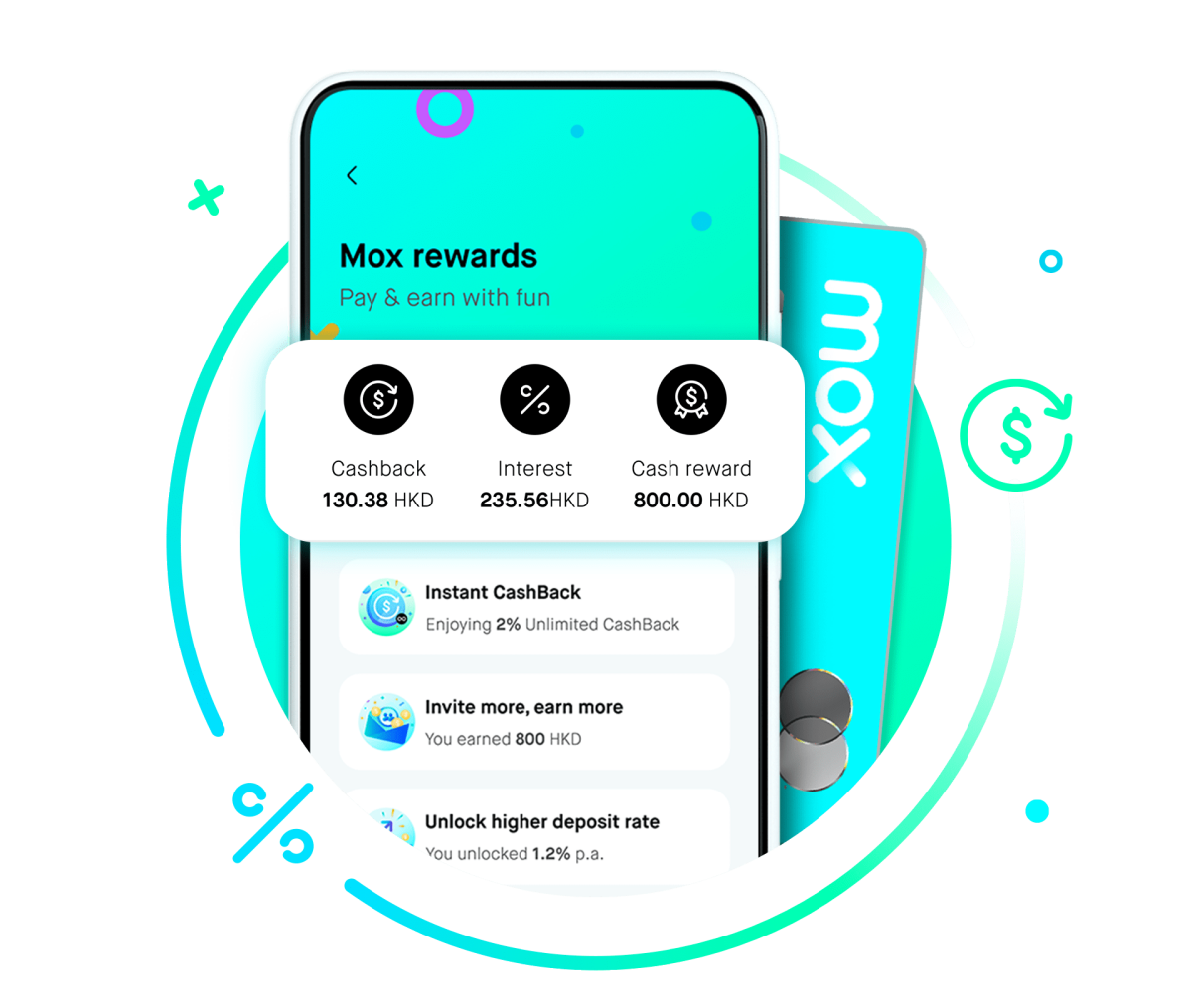

The only bank in Hong Kong that pays you cash every day

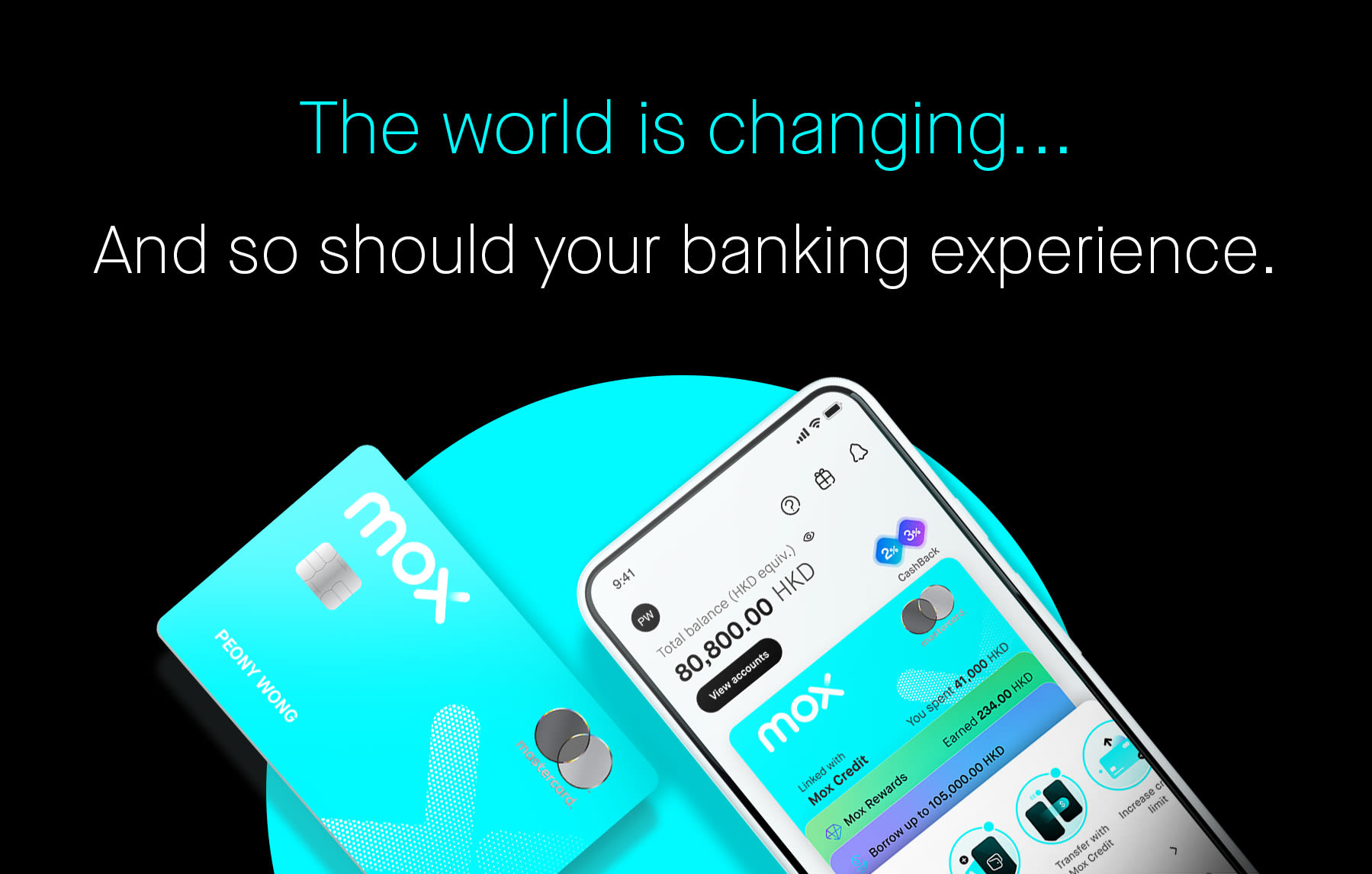

The world is changing, and your wealth game needs to keep up with the times.

With Mox, the interest on your savings is calculated and credited to your Mox Account daily – watch your savings grow faster as the interest keeps rolling in.

When you spend with Mox Credit⁵, your CashBack⁶ is also calculated instantly and credited daily to your Mox Account. What’s more, it’s the best in town 2% Unlimited CashBack – real cash, with no cap or category limits. Simply use your Mox Credit anytime, anywhere!

Watch your money grow with Mox

With Mox as your wealth management partner, watch your money grow right before your eyes.

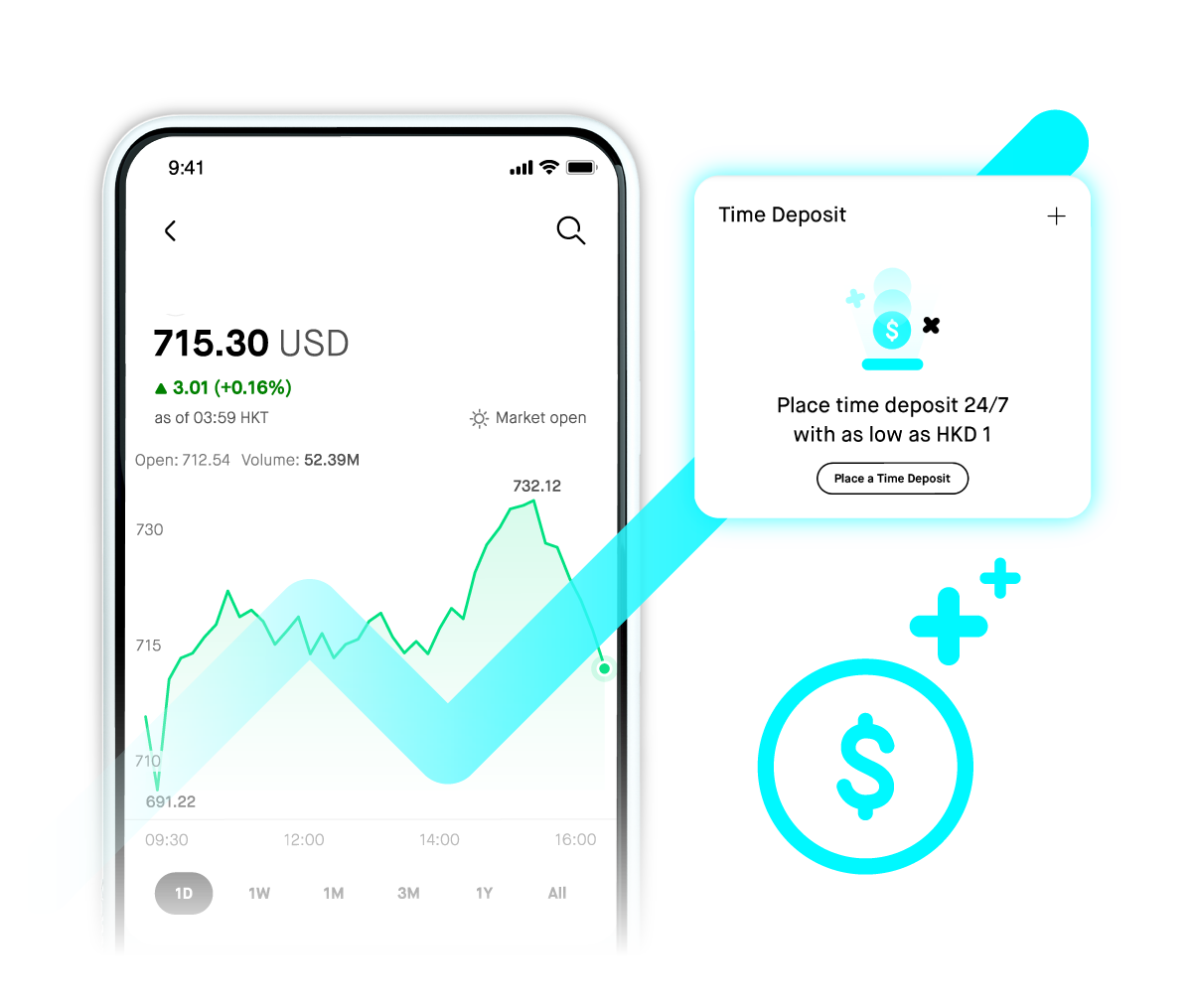

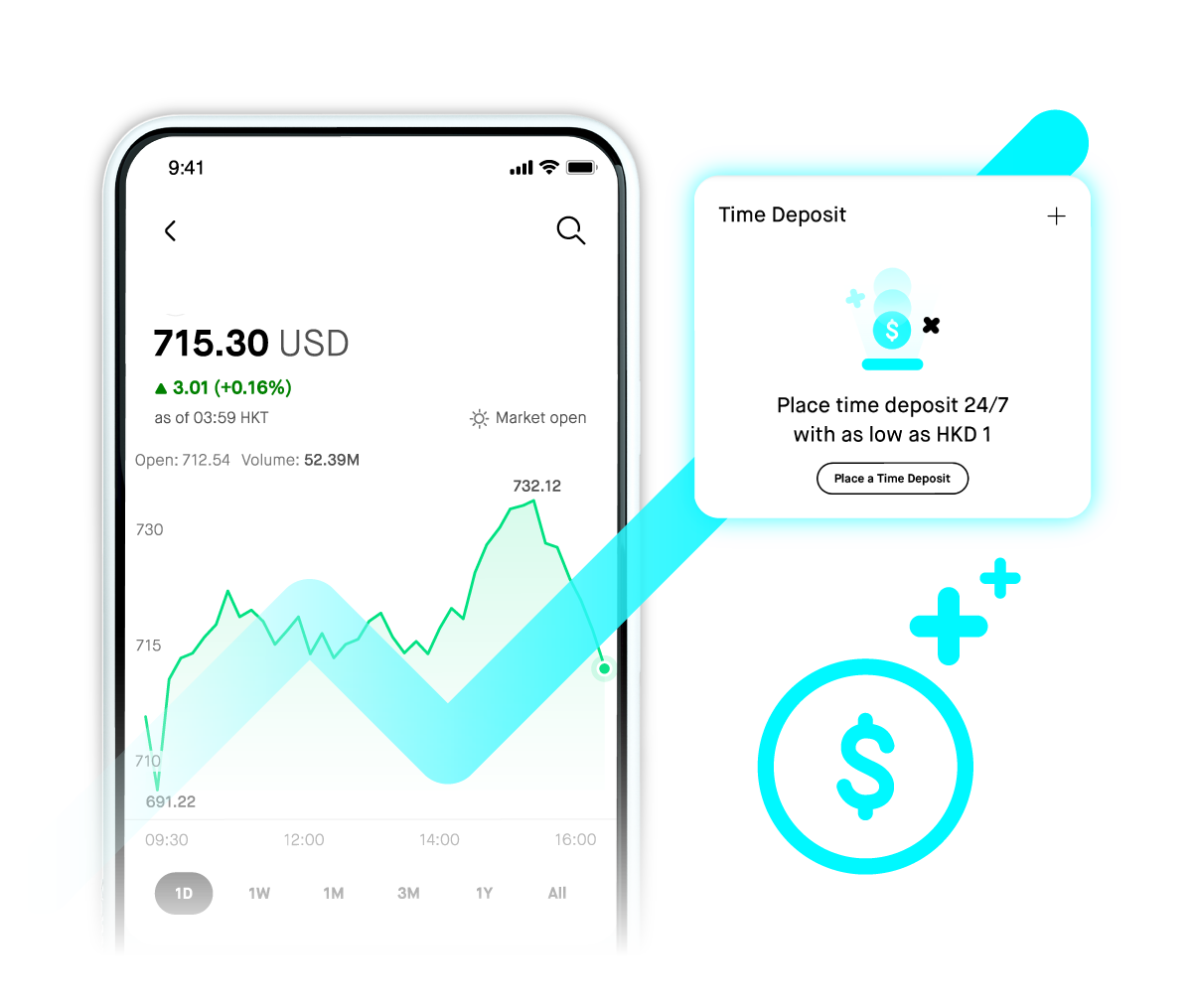

Mox Invest: Mox is the 1st digital bank that allows you to trade in both HK and US stocks, including fractional shares. Break free from entry barriers and invest with low fees⁷ in stocks and fund, all with the advantage of a bank.

Savings Rate: Take advantage of daily interest enjoy up to 0.5% p.a. on HKD savings. Starting 1 March 2025, for USD savings we also offer a 1% p.a. with no strings attached! Watch your savings grow every day!

Time Deposit: Mox gives you rewards for your Time Deposit instantly, right at the moment you place it. Whether you prefer cash or Asia Miles, you can earn either of them instantly with Mox!

Everything you need to make your money flourish is at the tap of a button with Mox.

Mox Credit, better than a credit card

Saving smart is great, but don’t forget to spend smart too. With Mox Credit, you’re not only enjoying Unlimited CashBack, but Mox Credit offers more than just a credit card.

Once your credit limit is approved, you’ll unlock a realm of banking services with Mox, no extra documents or headaches required:

- You can pay with Mox Credit via FPS, making daily transfers or paying bills, as easy as a breeze

- After spending, split your transactions instantly by Split Purchase or Split Your Statement, and easily manage your finance

Dream big. We’ve got your back

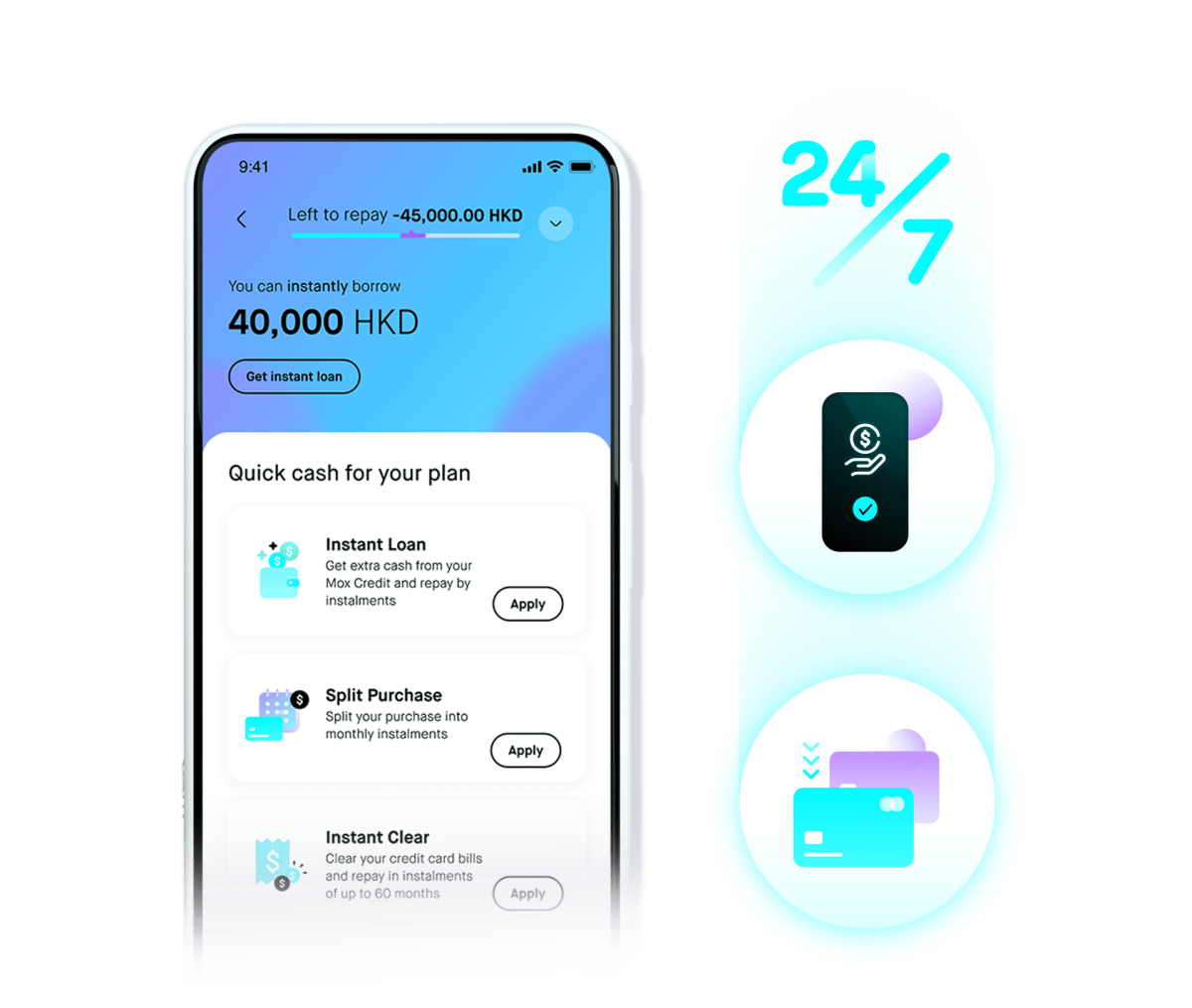

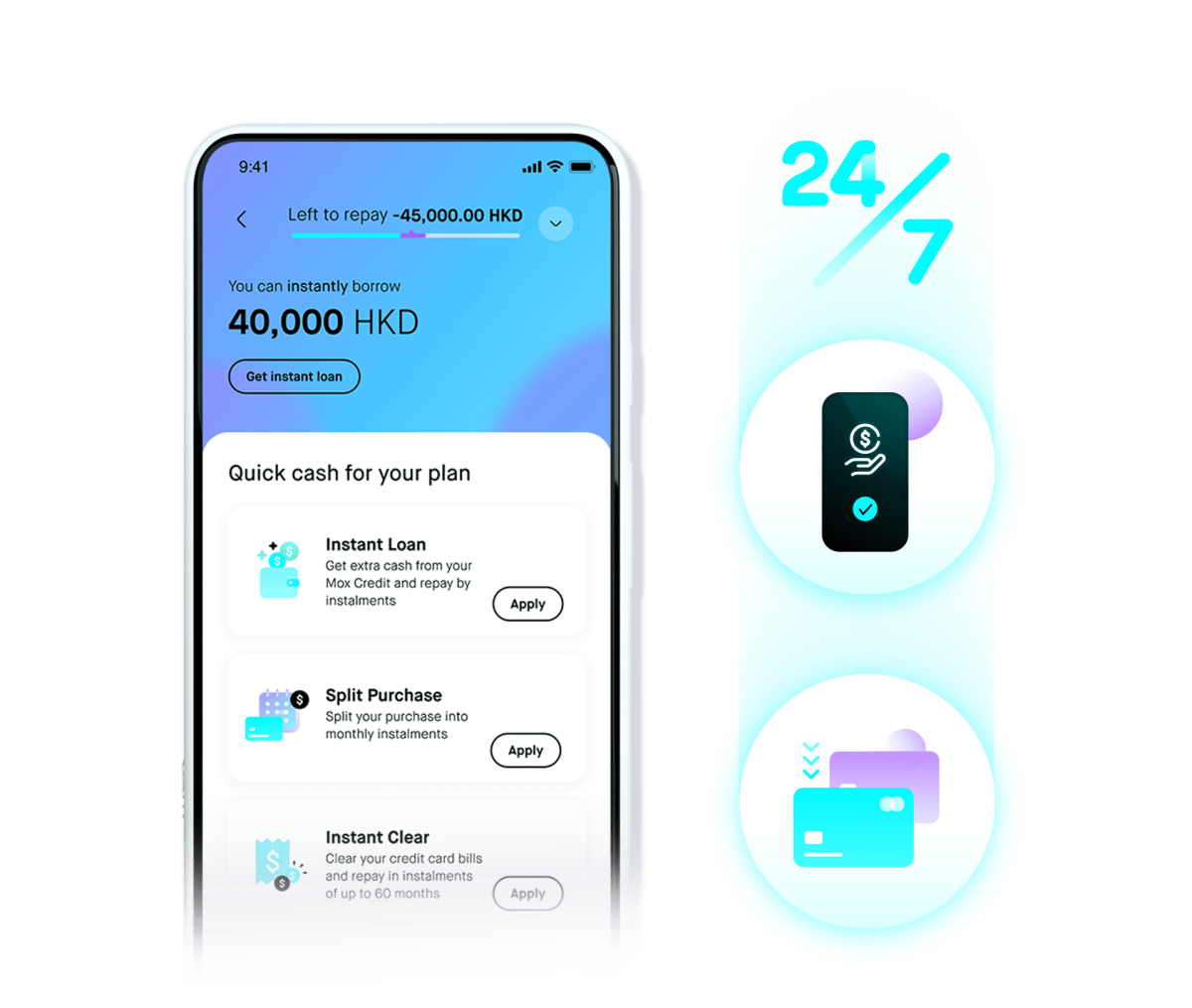

Besides smart money management, Mox has your back when you need extra cash for your dreams. Explore our instant solutions, available 24/7 with instant application decision – just a few clicks away:

- Get extra cash with Instant Loan, money arrives in as fast as a second upon approval

- With Instant Clear, clear your external credit card bills from other banks or financial institutions and save as much as 94%³𝄒⁴𝄒⁵ interest charges in a few minutes

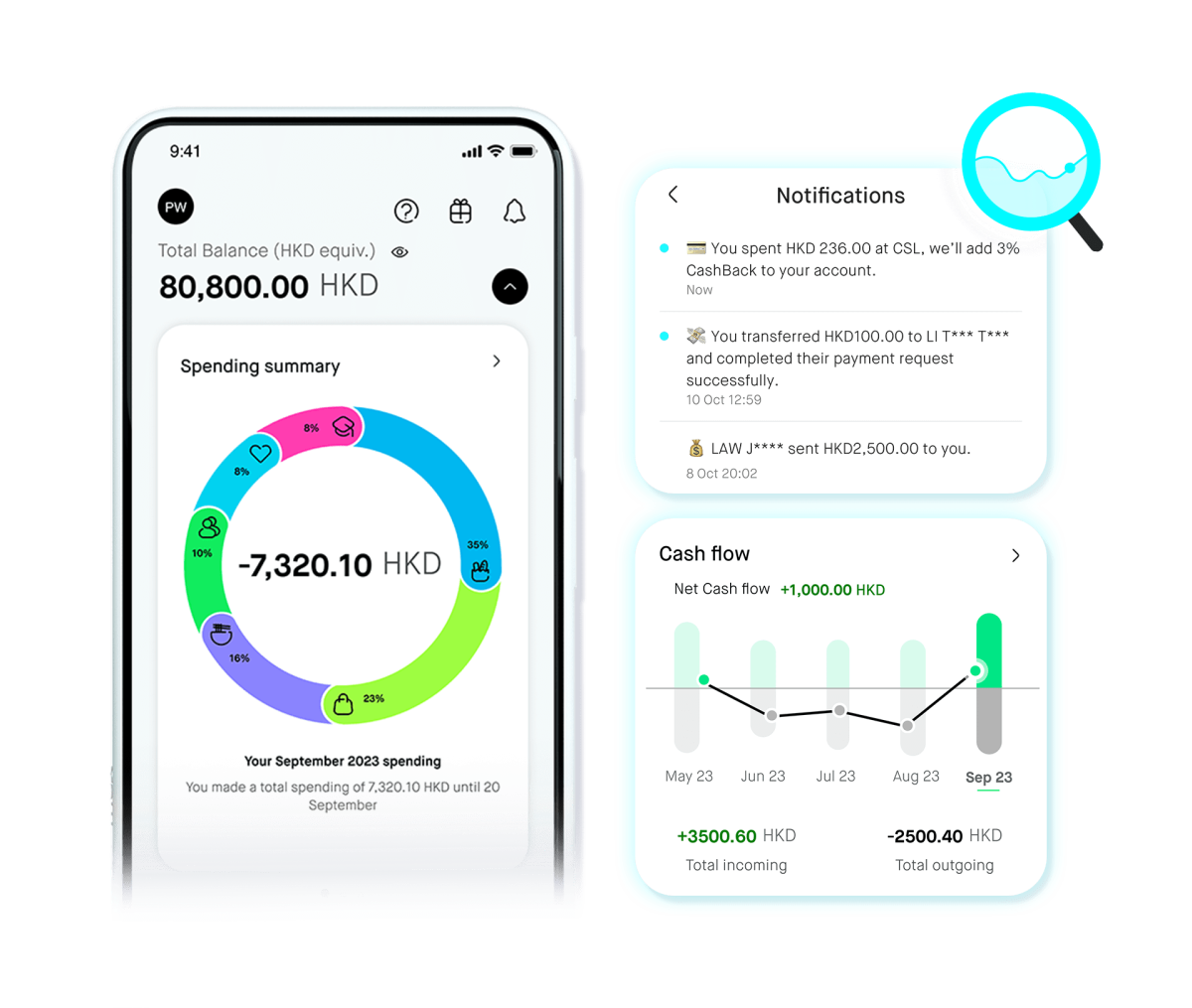

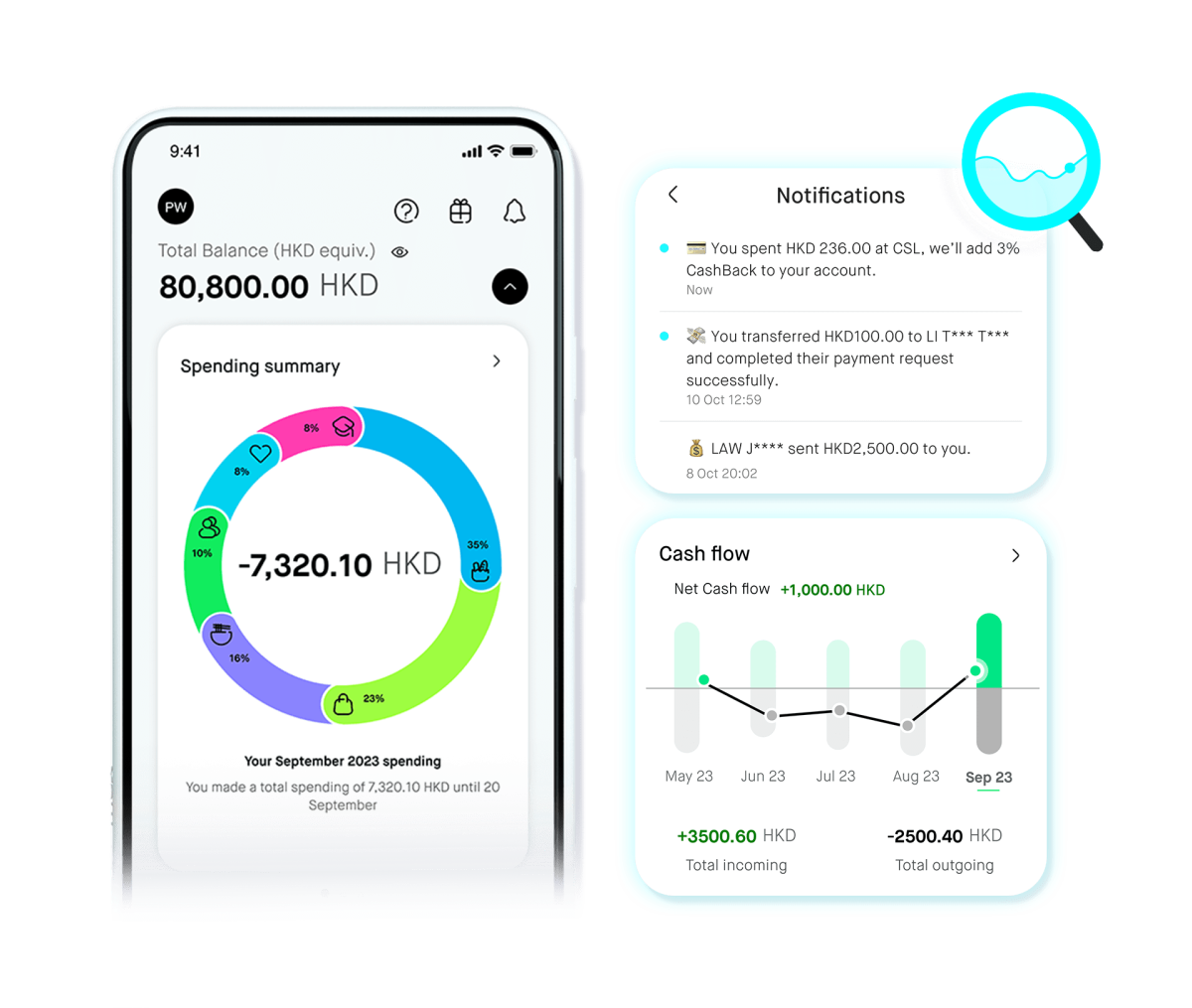

At Mox, there’s nothing you don’t know

- Get instant notification for every purchase, transfer, or any account activity for enhanced control and security

- Each transaction is clearly presented, allowing you to see at a glance

- Full transparency on all fees with no hidden charges