Smart Borrowing

Why Borrow with Mox?

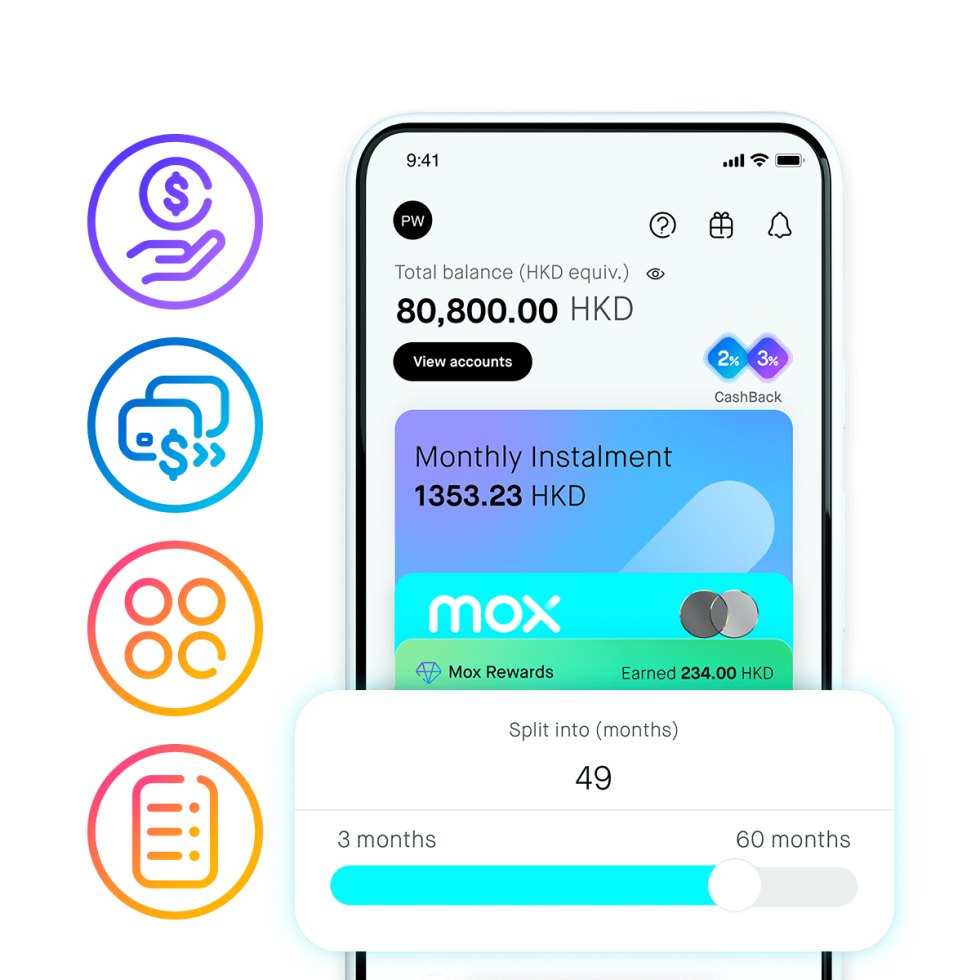

The world is constantly changing and opportunities can arise at any moment. That’s why it’s important to have flexibility when you need extra cash. Mox is here to provide you with an instant solution that gives you more control over your money. You can easily split your spending and repay in easy instalments, always get the cash you need, and quickly clear credit card debts in one go.

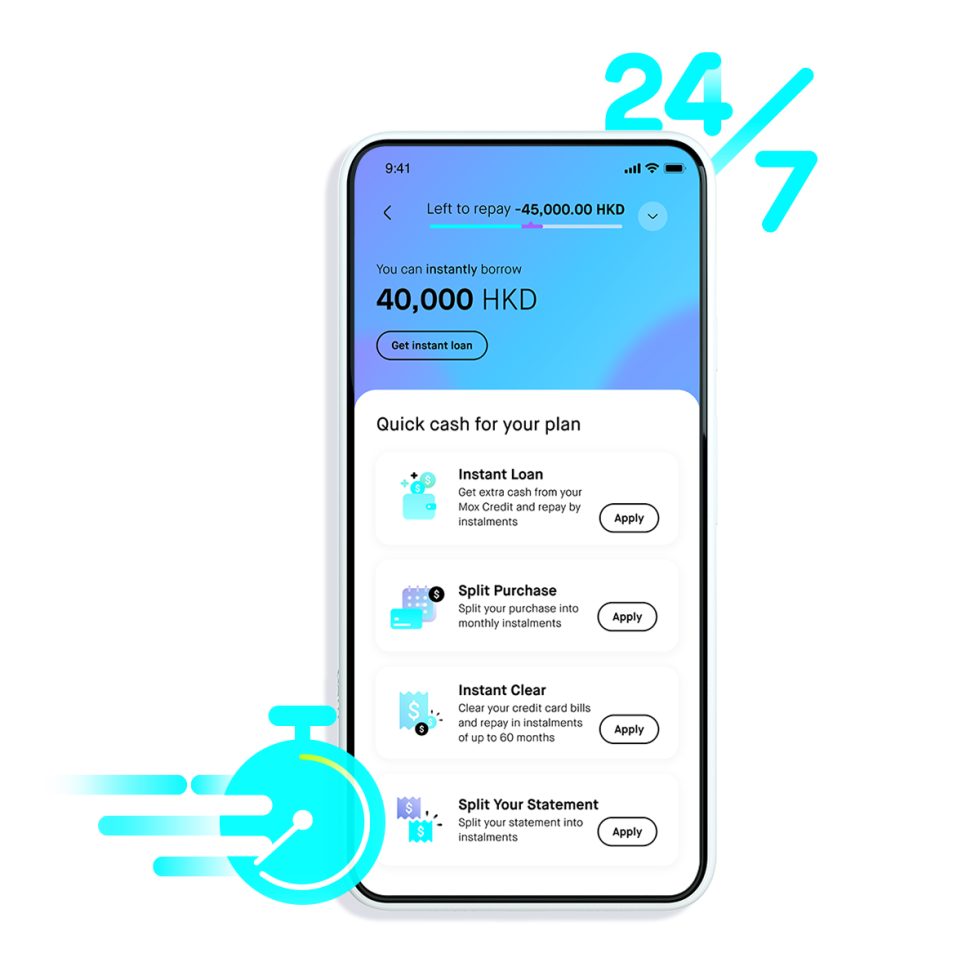

Everything is instant and available 24/7

From application to setup, it’s all done on the Mox app anytime, anywhere. There’s no waiting and no additional documents required. Once you apply, you’ll instantly get an application decision¹ . That means you’ll immediately receive the money you borrowed in your Mox Account with ‘Instant Loan’ or be able to pay your credit bills right away with ‘Instant Clear’.

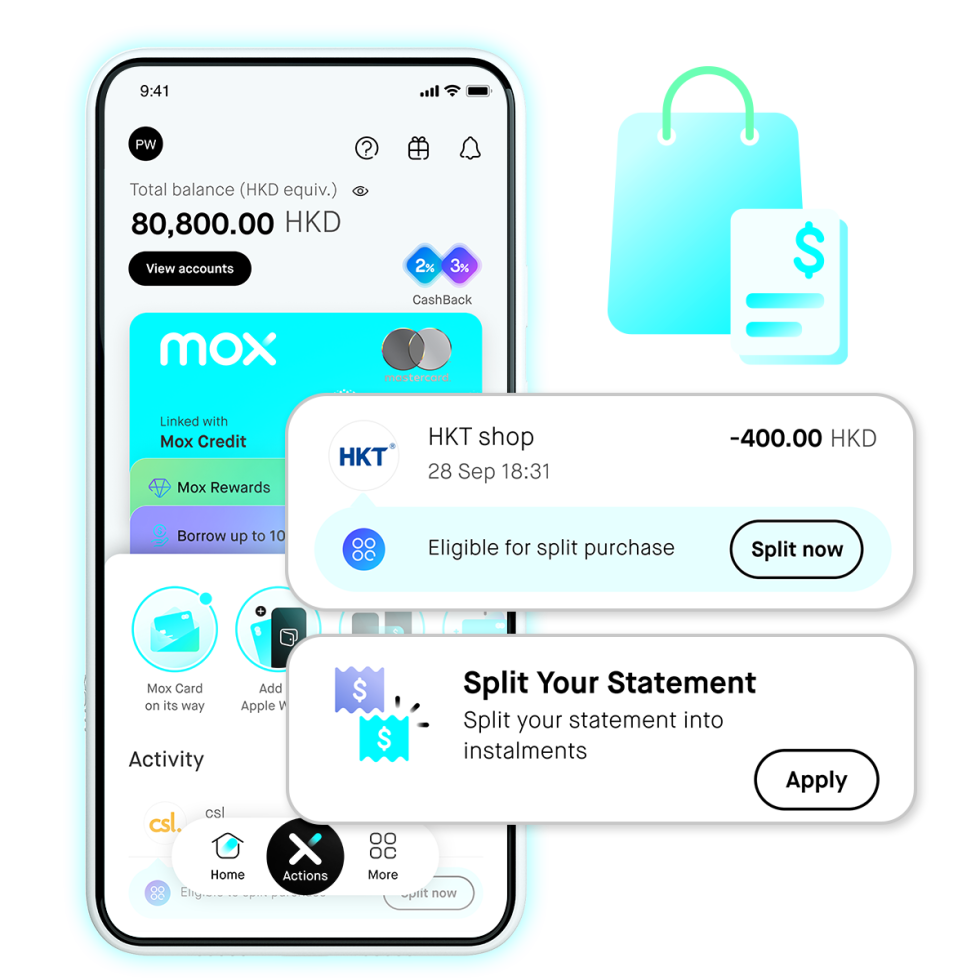

Split a purchase instantly, or any time you want

- When you make an eligible transaction of HKD400 or above, you can decide to split it right then and there or any time before your statement date

- Split your statement balance⁷ of HKD2,000 or above once the statement is released, and any time until 3 days before the payment due date

Enjoy more flexibility and control for repayment

It’s your choice any time between 3 and 60 months for Split Purchase, Split Your Statement, Instant Loan and Instant Clear.

You’ll get a competitive and transparent annual percentage rate (APR) which is updated in real time based on your selection. And best of all, there’s no late payment fee – no worries!

Check out examples below to see how much you can save with Instant Clear:

| Outstanding Balance of a Credit Card² | Mox Instant Clear³ʼ⁴ | |

|---|---|---|

| Loan amount | HKD100,000 | HKD100,000 |

| Repayment period (month) | 337 | 48 (-86%) |

| Average monthly repayment | HKD2,963 | HKD2,404 (-19%) |

| Total interest expense | HKD285,987 | HKD115,360 (-94%) |