Smart Spending

Why Spend with Mox?

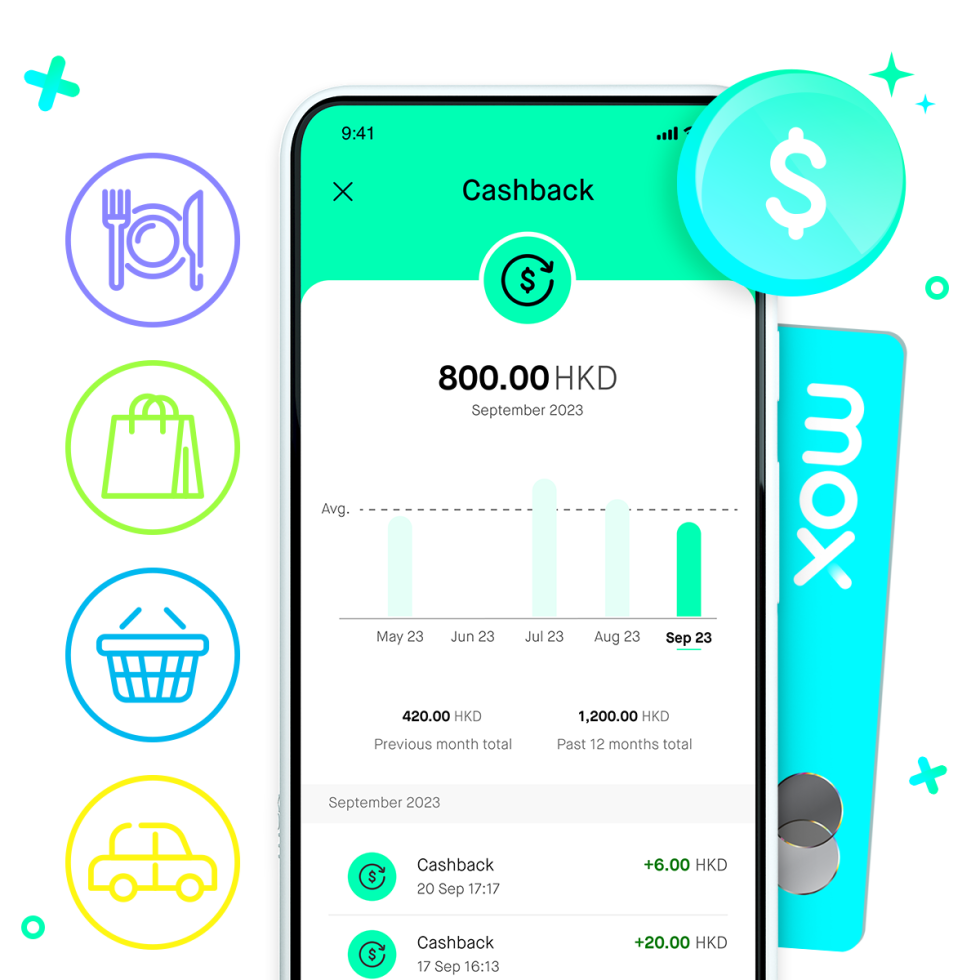

With Mox Credit¹, earn best in town* Unlimited CashBack⁶ everywhere as you spend

-

Earn 2% Unlimited CashBack²𝄒⁵ anywhere

-

Earn 3% Unlimited CashBack³ at supermarkets in Hong Kong

-

Selected CashBack Merchants for you to earn 3% CashBack⁴ (with spending cap)

-

CashBack is in real cash, not reward points or coupons

-

No cap, no categories limit

-

Calculated instantly, credited to your account daily

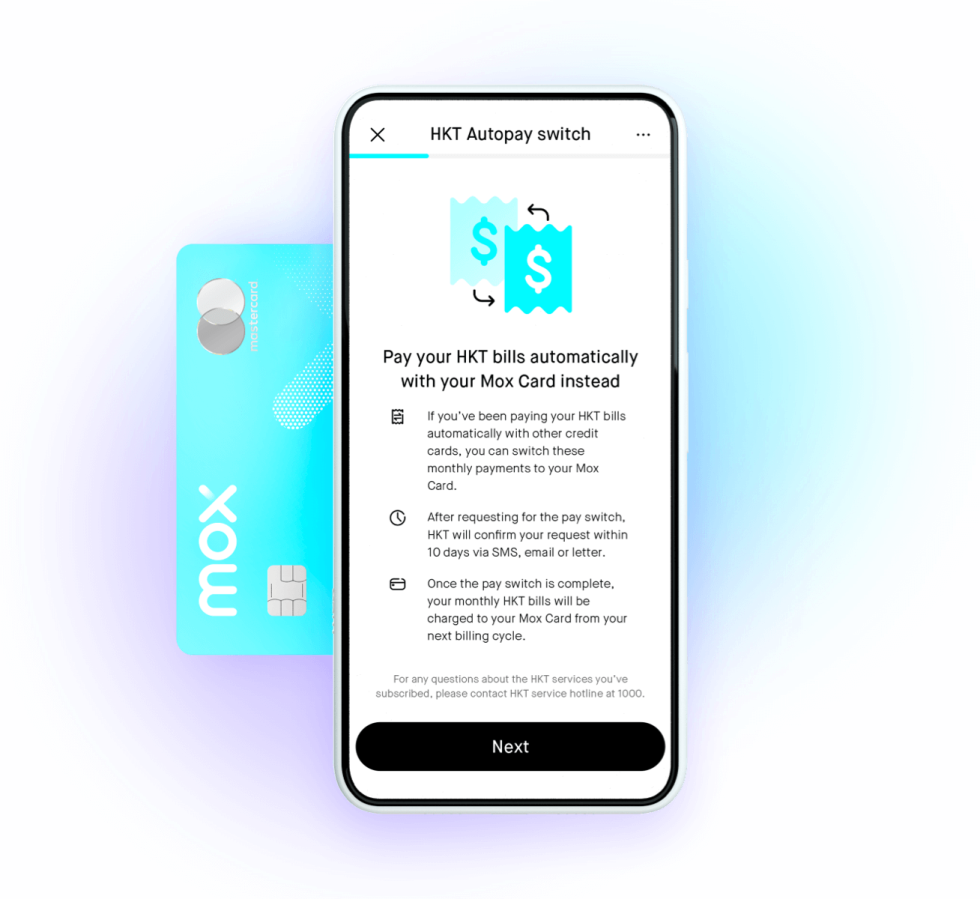

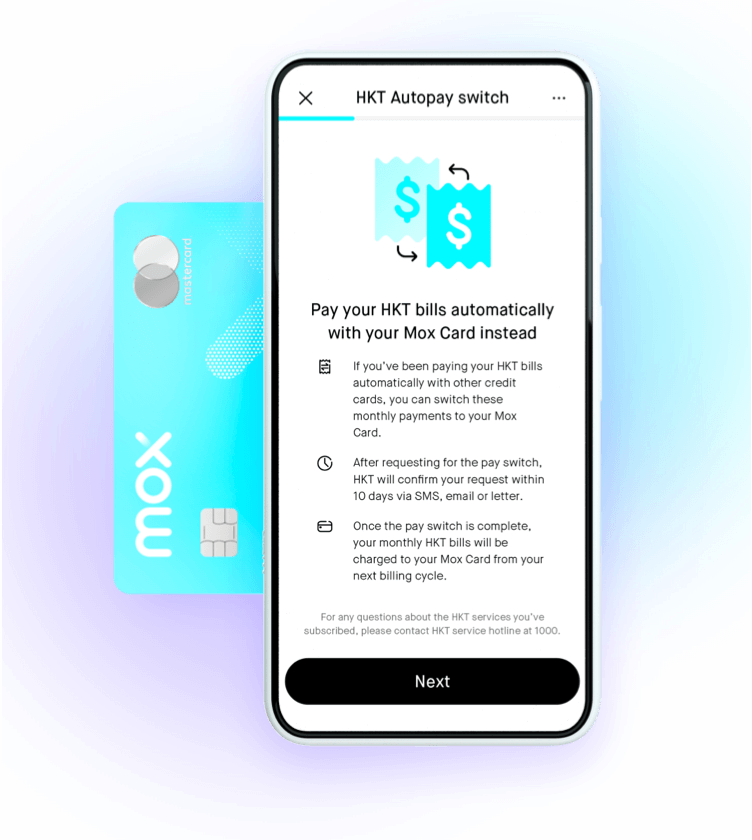

HKT Autopay Switch⁷: Autopay HKT bills and earn CashBack

Switch your HKT bills to Mox Credit in the Mox app in just a few taps and enjoy 3% CashBack².

- It’s no fuss. Once you’ve received HKT’s confirmation, you’re all set!

- See all your HKT bill payments in one place

- HKT bill payments that can earn 3% CashBack⁴

HKT services include: 1O1O, csl, NETVIGATOR, Now TV, HKT Home Phone, IDD 0060 and HKT eye

Exclusive for Mox Credit customers who have been paying their HKT bills automatically with other credit cards.

Mox Card - The only card you need

- Enjoy the best of both worlds

Flip between spending from your Mox Account (debit) or with Mox Credit (credit), anytime.

- Global ATM services

Enjoy more than 2,000 JETCO ATMs in Hong Kong for free, and access over 2.6 million ATMs worldwide that accept Mastercard.

- Asia’s first numberless all-in-one bank card

With no card number, expiry date or CVV visible on the card, the Mox Card reduces your risk of losing personal information. Update your daily limit and ATM PIN with the tap of a finger in the Mox app!

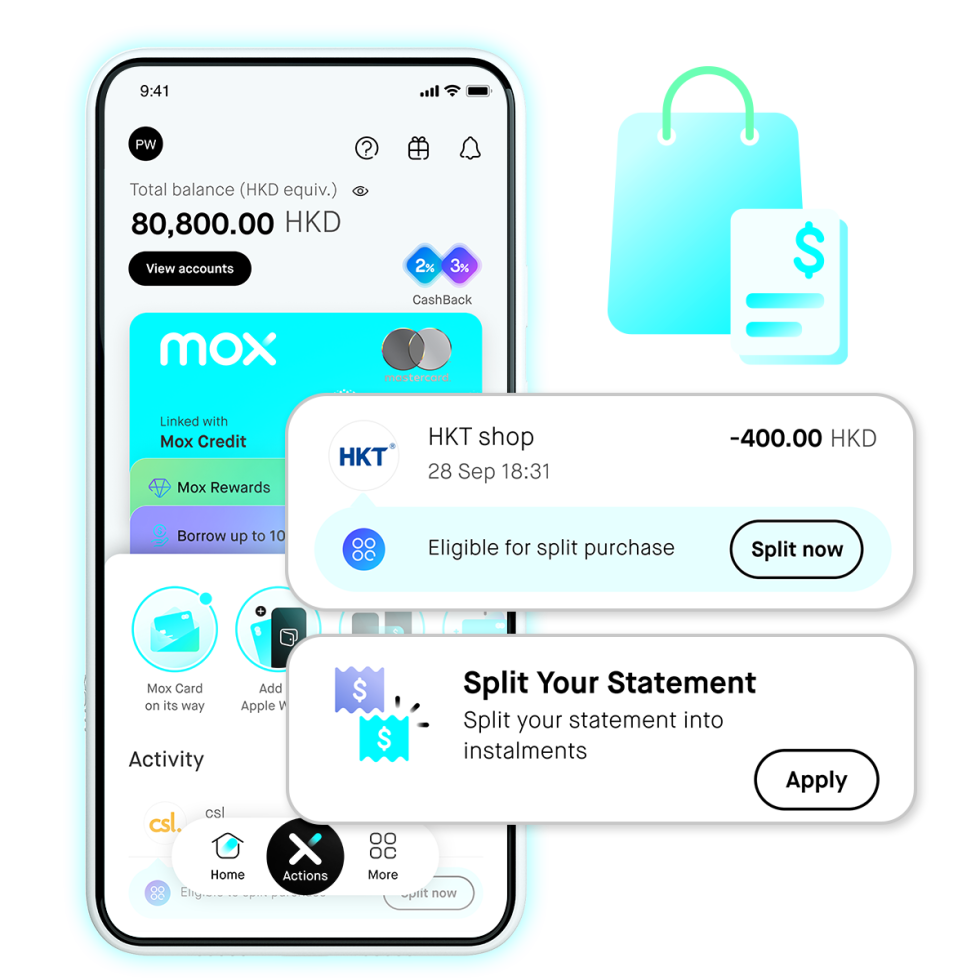

Split Purchase / Split Your Statement, it’s all up to you⁸

- Choose a payoff timeframe between 3 to 60 months

- Transparent annualised percentage rate (APR)¹⁰ – updated in real time based on your chosen payoff timeframe

- Choose a single or multiple eligible Mox Credit transaction of HKD400 or above to apply for a Split Purchase

- Split your statement balance⁹ of HKD2,000 or above once it’s released the statement, or any time until 3 days before the payment due date

Split in-store with 0% interest¹¹

- Enjoy 0 interest and 0 fee for Split Purchase with Mox Credit at designated merchants

- Choose a repayment period between 3-60 months

- Enjoy unlimited splits, as many purchases as you want

- You can still earn 2% Unlimited CashBack²⁻⁶ on your spending

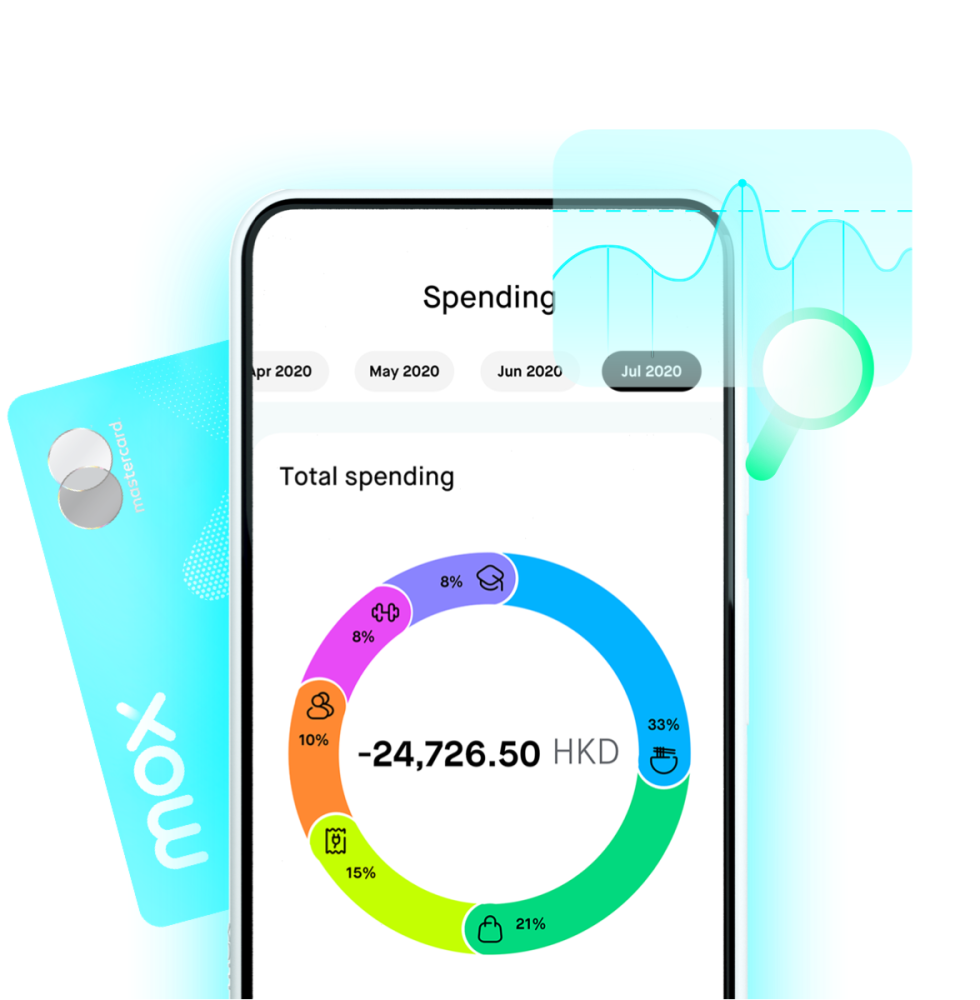

Manage your spending more easily

- Insights to help you with budgeting and avoid overspend

Monitor real-time account activity and balance with instant categorisation.