Enjoy 0% interest with Instant Clear

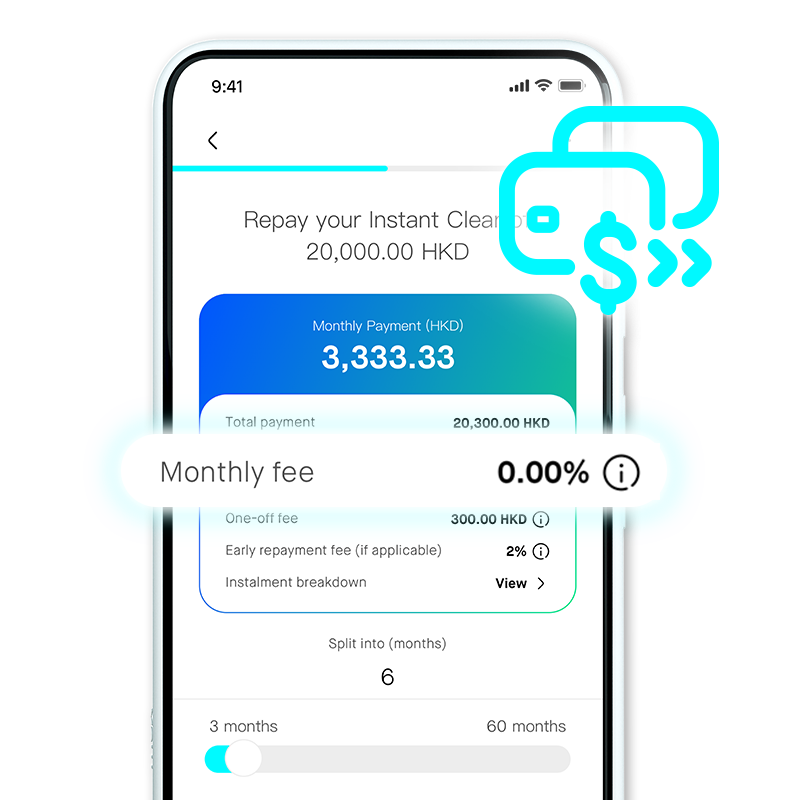

Clearing your external credit card bills from other banks or financial institutions is so easy and affordable now – simply apply for an Instant Clear with a repayment period of 3 to 6 months and a loan amount of below HKD75,000, you can now enjoy 0% interest¹!

Clear your external credit card bills now with 0% interest¹ Instant Clear to save more!

When you choose to repay your Instant Clear of below HKD75,000² in 3 to 6 months, you can enjoy 0% interest¹, and only a one-off fee listed below will be charged.

| Instant Clear Amount | One-off fee | |

|---|---|---|

| A repayment period of 3 months | A repayment period of 4-6 months | |

| HKD20,000 or below | HKD200 | HKD300 |

| HKD20,001 to HKD74,999 | HKD800 | HKD1,200 |

For the APR of Instant Clear, please refer to the Mox app³.

Compare interest expenses at a glance

Instant Clear doesn’t require any additional documents. Everything is done via your Mox app, so you can apply and clear your other banks’ or financial institutions’ credit card bills in just a few minutes.

Check out examples below to see how much you can save with Instant Clear:

| Outstanding Balance of a Credit Card⁴ | Instant Clear⁵𝄒⁶ | |

|---|---|---|

| Loan amount | HKD100,000 | HKD100,000 |

| Repayment period (month) | 337 | 48 (-86%) |

| Average monthly repayment | HKD2,963 | HKD2,404 (-19%) |

| Total interest expense | HKD285,987 | HKD115,360 (-94%) |