Mox Credit¹

Mox Credit Card offers flexible choices: Earn Asia Miles or CashBack! Switch whenever you like!

The new way of miles earning: For all spending HKD4=1 mile³ + 0 Limits + 0% FX Fees⁴

Earn with no limit! 2% Unlimited CashBack²˙⁵ everywhere

From dining, shopping, travel to transportation, you can earn 2% Unlimited CashBack! Mox allows you to enjoy the freedom with no limit!

- Keep HKD250,000 in Mox Account (not including Time Deposit)

*You can still earn 1% Unlimited CashBack even if your total eligible balance falls below the above threshold.

Earn 3% Unlimited CashBack⁶ at all supermarkets

Cash rewards don’t stop here – earn 3% Unlimited CashBack at major supermarkets in Hong Kong!

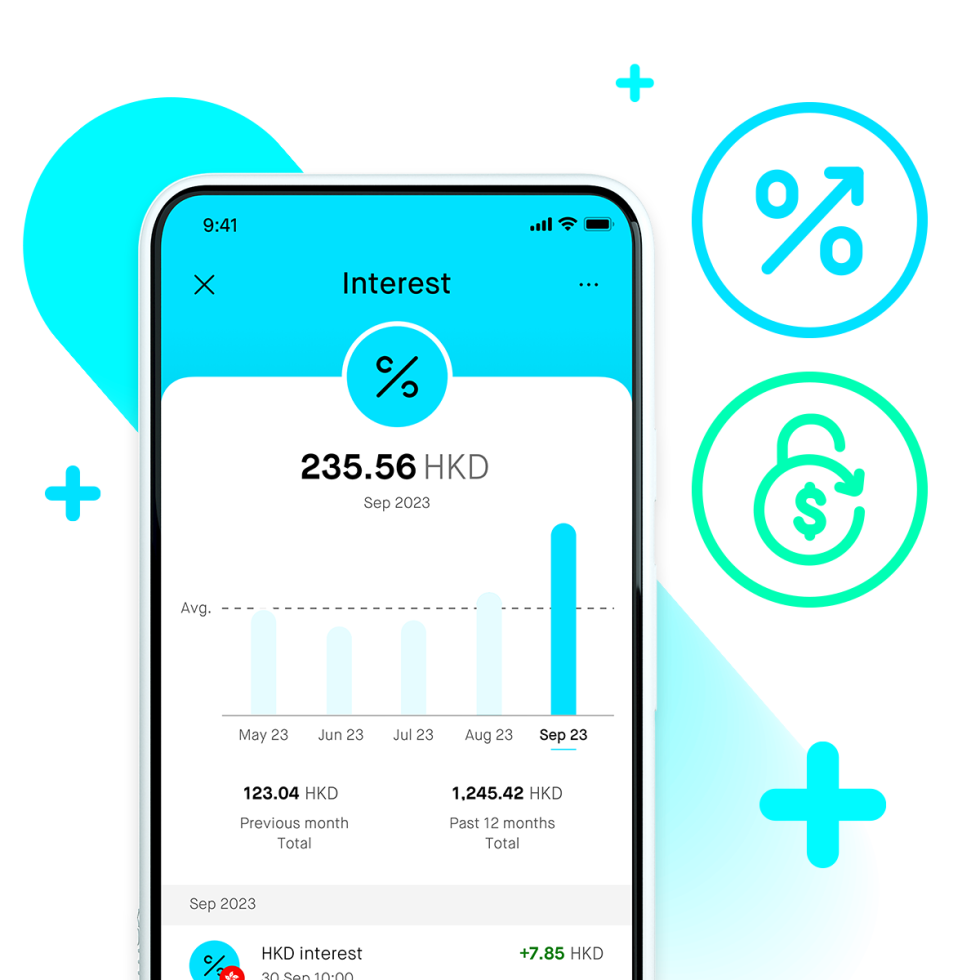

Spend, earn and don’t forget to save, and unleash unlimited possibilities

No matter your daily expenses, travel plans or life goals, Mox is here to back you up. Get closer to the Goals you're saving for with daily interest on all your money with Mox, no matter how small.

- Enjoy up to 4.5% savings rate⁸, exclusive for new customers. When your total eligible balance with us reaches HKD250,000 or more, you can enjoy 2% Unlimited CashBack

Apply now! 24/7 - No annual fee

Your Mox Credit application takes minutes to apply and simple

- Only need your HKID Card

- Get an instant application decision¹ and spend right away

- Simple document submission process (if required)

- Physical Mox Card will be delivered to you

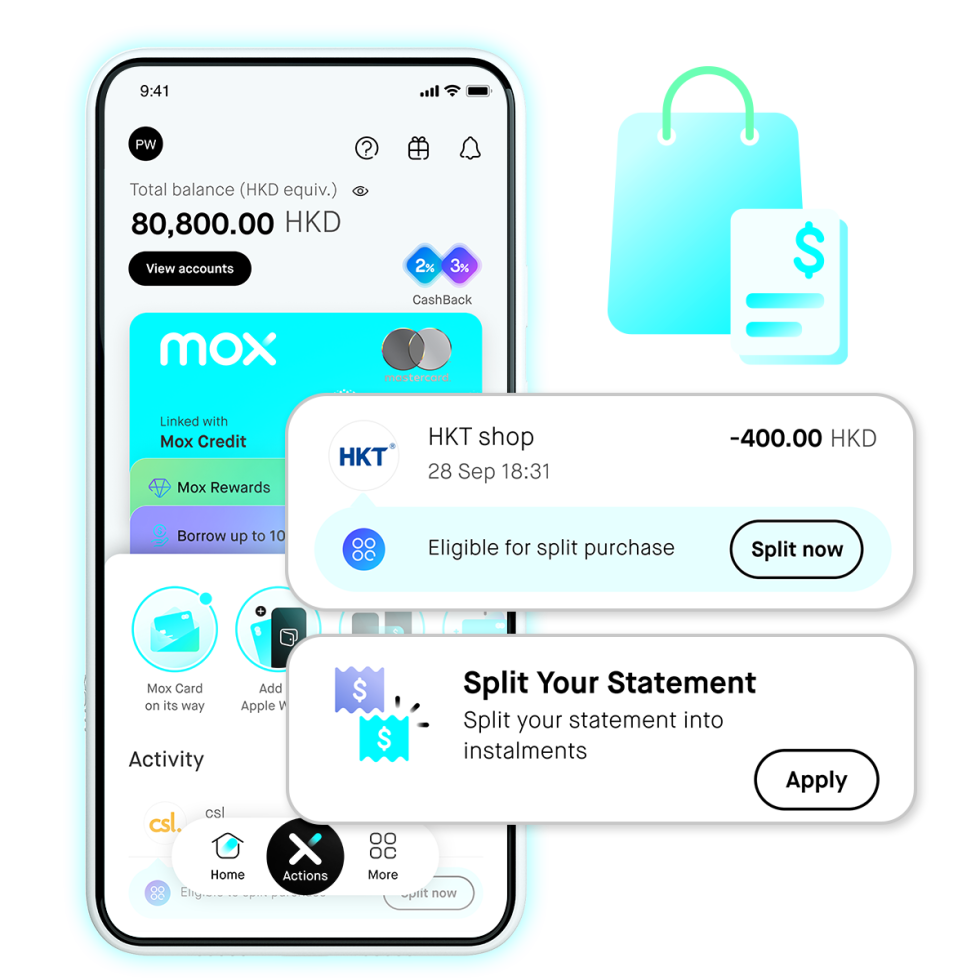

Split your purchases / Split Your Statement⁹, it’s all up to you

- Choose a payoff time frame between 3 to 60 months

- Transparent annualised percentage rate (APR)¹⁰ – updated in real time based on your chosen payoff time frame

- Choose a single or multiple eligible Mox Credit transactions of HKD400 or above to apply for a Split Purchase

- Split your statement balance¹¹ of HKD2,000 or above once the statement is released, and any time until 3 days before the payment due date

Enjoy greater flexibility

Transfer easily and flexibly with Mox Credit

Mox is the first digital bank in Hong Kong that allows you to transfer money with FPS via credit¹². Whatever you might be using FPS for, whether it’s transferring money to friends, paying rent, or purchasing goods, you can now enjoy greater flexibility. Transfer immediately and pay later with up to 56 days interest-free. View and manage all your spending at a glance with the Mox Credit categorisation feature.

One Mox Card does it all

- Spending on Mox Credit and from Mox Account (debit) on the same card

- ATM card

- Physical card

- Digital card

- Apple Pay and Google Pay

- Extra security and privacy protection enabled by the numberless physical card design

Apply for Mox Credit

Plan Your Mox Credit Repayments

A smarter way to calculate and time your repayments

*Compared against 27 credit cards in Hong Kong regarding unlimited cash rebate as published on official website as of 8 March 2024.

¹Our General Terms and Conditions (in particular, see Schedule 3) and the Mox Credit Key Facts Statement apply.

Friendly reminder: You can only apply for Mox Credit once your Mox Account has been successfully opened. In some circumstances, we may require you to provide supporting documents by a simple submission process when you apply for Mox Credit. The approval time for Mox Credit is subject to a customer’s individual circumstances.

²Clause 9 of Schedule 1(Terms and Conditions for Accounts and Card Management) to the General Terms and Conditions (which can be found in the Mox app and/or on our website) applies.

³The Rewards for Cards Schedule applies (which can be found in the Mox app and/or on our website). From 4 November 2024, if you have an Eligible Balance for Card Rewards of HKD250,000 or more at the time you make an eligible Mox Credit Card transaction, you may earn HKD4 = 1 Asia Mile on the amount of the eligible Mox Credit Card transaction. From 4 November 2024 to 30 September 2025 (both dates inclusive), if you have an Eligible Balance for Card Rewards of below HKD250,000 at the time you make an eligible Mox Credit Card transaction, you may earn HKD8 = 1 Asia Mile on the amount of the eligible Mox Credit Card transaction. From 1 October 2025, if you have an Eligible Balance for Card Rewards of below HKD250,000 at the time you make an eligible Mox Credit Card transaction, you may earn HKD10 = 1 Asia Mile on the amount of eligible Mox Credit Card transaction. “Eligible Balance for Card Rewards” means the ‘available cash balance’, any ‘cash on hold’ and any ‘cash on hold for fund(s)’ in your savings accounts with Mox. For the avoidance of doubt, any ‘cash on hold from unsettled cash’ in your Mox Invest Account or balances in your Time Deposit Account(s) will not constitute ‘Eligible Balance for Card Rewards’.

⁴FX Fees refer to the Foreign Exchange Handling Fee and the Cross-Border Access Fee. 0% Foreign Currencies and Overseas Merchant Spending Fees Promotion Terms and Conditions apply.

⁵The Rewards for Cards Schedule applies (which can be found in the Mox app and/or on our website). From 4 November 2024, if you have an Eligible Balance of HKD250,000 or more at the time you make an eligible Mox Credit Card transaction, you may earn Unlimited CashBack calculated at 2% on the amount of the eligible Mox Credit Card transaction. From 4 November 2024, if you have an Eligible Balance of below HKD250,000 at the time you make an eligible Mox Credit Card transaction, you may earn Unlimited CashBack calculated at 1% on the amount of the eligible Mox Credit Card transaction. “Eligible Balance” means the ‘available cash balance’, any ‘cash on hold’ and any ‘cash on hold for fund(s)’ in your savings accounts with Mox. For the avoidance of doubt, any ‘cash on hold from unsettled cash’ in your Mox Invest Account or balances in your Time Deposit Account(s) will not constitute ‘Eligible Balance’.

⁶From 26 September 2023, earn unlimited CashBack calculated at 3% on the amount of the eligible transaction made with Mox Credit made at ‘supermarkets and grocery stores’, as classified by MasterCard Asia/Pacific (Hong Kong) Limited.

⁷From 1 June until 31 July 2025, earn Cash Reward calculated at 3% on the amount of the eligible transaction made with Mox Credit at Selected Merchants of up to HKD100. Selected Merchants 3% Cash Reward Promotion Terms and Conditions applies.

⁸Savings Base Rate Enhancement Scheme Terms and Conditions and Welcome Bonus Promotion (February – March 2024) Terms and Conditions apply.

⁹General Terms and Conditions (in particular, see Part A: Split Purchase of Schedule 3) and the Split Purchase Key Facts Statement apply. Refer to legal terms and conditions for more details. The fees for Split Purchase will be reviewed from time to time. Each monthly instalment for a Split Purchase is charged to Mox Credit and will show on your Mox Credit statement. Please pay your Mox Credit statement balance in full on or before its due date to avoid finance charges (interest).

¹⁰The APR is calculated using method specified in relevant guidelines issued by the Hong Kong Associations of Banks. The APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualised rate.

¹¹Only certain types of Mox Credit transactions and amounts of Mox Credit statement balances are eligible for Split Purchase, as determined by us in our absolute discretion. The examples of transactions and amounts of Mox Credit statement balances that are ineligible for Split Purchase are listed in General Terms and Conditions (in particular, see Part A: Split Purchase of Schedule 3) – clause 8(d).

¹²Whether you can transfer money using your Mox Credit depends on multiple factors. You may be restricted from using Mox Credit to make transfers even if there is available balance in your Mox Credit account.