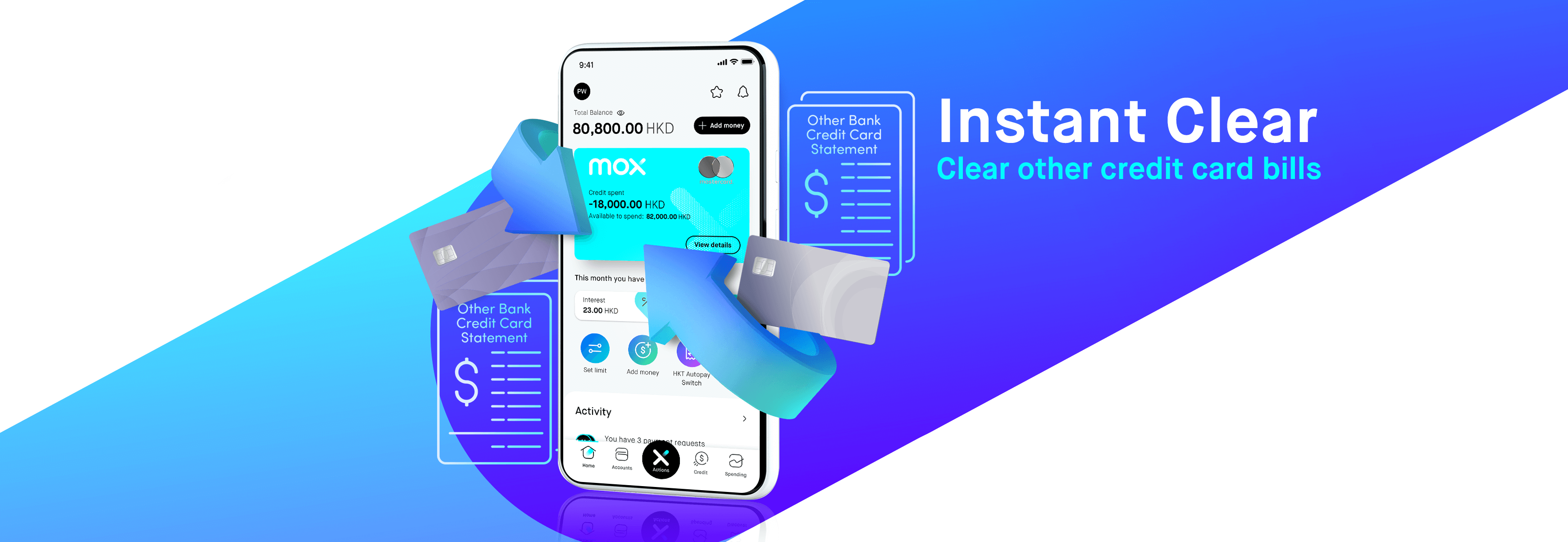

Mox Launches 'Instant Clear' to Offer Smarter Control Over Other Credit Card Bills During the Pandemic

Mox Credit customers can clear credit card bills with other banks or financial institutions instantly at an APR as low as 2.80%³

Hong Kong, 9 March 2022 – Mox Bank Limited (“Mox”) is offering all Mox Credit¹ customers a smarter way to clear their credit card bills with ‘Instant Clear’ Credit Card Balance Transfer Plan². ‘Instant Clear’ is a loan that customers can draw from their Mox Credit balances to repay their outstanding credit card balances of HKD5,000 and above with other banks or financial institutions effortlessly and instantly. The timely offering also provides much-needed financial relief for Hongkongers facing rising costs as COVID-19 cases rise.

When Mox Credit customers successfully apply for ‘Instant Clear’, they can enjoy easy instalments of up to 60 months at an Annualised Percentage Rate (“APR”) as low as 2.80%³ and an interest-free period of up to 56 days. This means that for every HKD10,000 of ‘Instant Clear’ that a Mox Credit customer applies for, with a repayment period of between 48 and 60 months, the customer will only pay as low as HKD12 in fees and interests each month.

Barbaros Uygun, CEO of Mox, said: “Mox’s new ‘Instant Clear’ continues our efforts to make it easier for our Mox Credit customers to reach their financial freedom. The current economic uncertainty has saddled many with high credit card bills and increased financial anxiety. We are offering a smarter way to pay off these bills, allowing our customers to take back control of their financial future and their lives.”

Applying for ‘Instant Clear’ follows Mox’s approach of keeping everything simple and convenient for Mox Credit customers. They can simply choose ‘Instant Clear’ under the ‘Credit’ tab on their Mox app and follow the steps to complete the application.

‘Instant Clear’ is offered using the ‘available to spend’ balance on Mox Credit. Mox Credit customers with sufficient credit limits can complete the application process on their Mox app within minutes without submitting additional documents. If Mox Credit customers wish to apply for an ‘Instant Clear’ amount that is higher than their credit limit, they need to apply for a higher credit limit for their Mox Credit in their Mox app first.

To borrow or not to borrow? Borrow only if you can repay!

¹Terms and conditions apply (in particular, see Schedule 3 to the General Terms and Conditions). You can view the terms in the “Legal documents” section of our website and the “About us” page in the Mox app.

²Terms and conditions apply (in particular, see Schedule 3 to the General Terms and Conditions). You can view the terms in the “Legal documents” section of our website and the “About us” page in the Mox app.

³The APR ranges from 2.80% to 24.53% and repayment period of 3 to 60 months. The APR of 2.80% is calculated based on repayment tenor of 48 – 60 months for the Instant Clear loan. The APR is calculated using methods specified in relevant guidelines as set out in the Code of Banking Practice. The APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualised rate. The APR for an Instant Clear loan is subject to Mox’s final decision on a case-by-case basis and the Mox Credit account status at the time Mox receives the Instant Clear application. Please refer to the Instant Clear Credit Card Balance Transfer Plan Key Facts Statement for details.