Mox Turns Three, Unveils Best In Town Unlimited CashBack and Brand-New App Interface

Hong Kong, 28 September 2023 – Mox Bank Limited ("Mox") is setting a new standard for virtual banking in Hong Kong, marking its third anniversary with a series of exciting announcements. These include the introduction of the best in town¹ Unlimited CashBack² rewards to enhance savings for Mox customers, and a new user interface for the Mox app that takes its customer experience to new heights.

Barbaros Uygun, CEO of Mox, said: “Mox is setting the global benchmark for digital banking from Hong Kong and offers enhanced value to Hong Kong consumers as we reimagine banking. Stepping into a new year, we are excited to expand the Mox offerings through attractive rewards and a remarkable app upgrade."

Celebrate 3 with additional attractive CashBack rewards

Mox is celebrating its third anniversary with enticing Unlimited CashBack rewards for Mox Credit customers. These include:

- 1% Unlimited CashBack³ on any spending;

- 2% Unlimited CashBack⁴ on any spending if you have a savings balance of HKD75K or above ;

- 3% Unlimited CashBack⁵ on all supermarkets, including Fusion, Market Place, Wellcome, and ParknShop, making everyday purchases more affordable.

From 26 September to 31 December 2023, Mox Credit customers can also earn 3% Cashback⁶ up to HKD600 at selected CashBack merchants including HKT, Trip.com, 7-Eleven, Circle K, Mannings, Watson’s, etc.

"We are always looking to increase benefits to our customers in meaningful ways. Simple and everyday banking with Mox helps customers earn even more — they can save more and earn more interest and CashBack rewards to get closer to their goals. They are also our token of appreciation for their loyalty during our journey so far,” said Uygun.

Getting ready to invest differently

Mox is also entering the wealth management space with Mox Invest.

Currently, Mox is piloting Mox Invest’s Hong Kong and U.S. equity trading service in the sandbox. It is also looking to add a Securities and Futures Commission (SFC) authorised yield enhancement fund that will only be available via the Mox app in collaboration with a world-renowned partner. In addition, Mox is exploring new portfolio investment solutions.

“Mox Invest extends our user experience to wealth management. It follows our customer promises of keeping investing simple and smart at a low cost. We want to make the investment experience less cumbersome so customers can focus on building their wealth and capture investment opportunities quickly,” said Uygun.

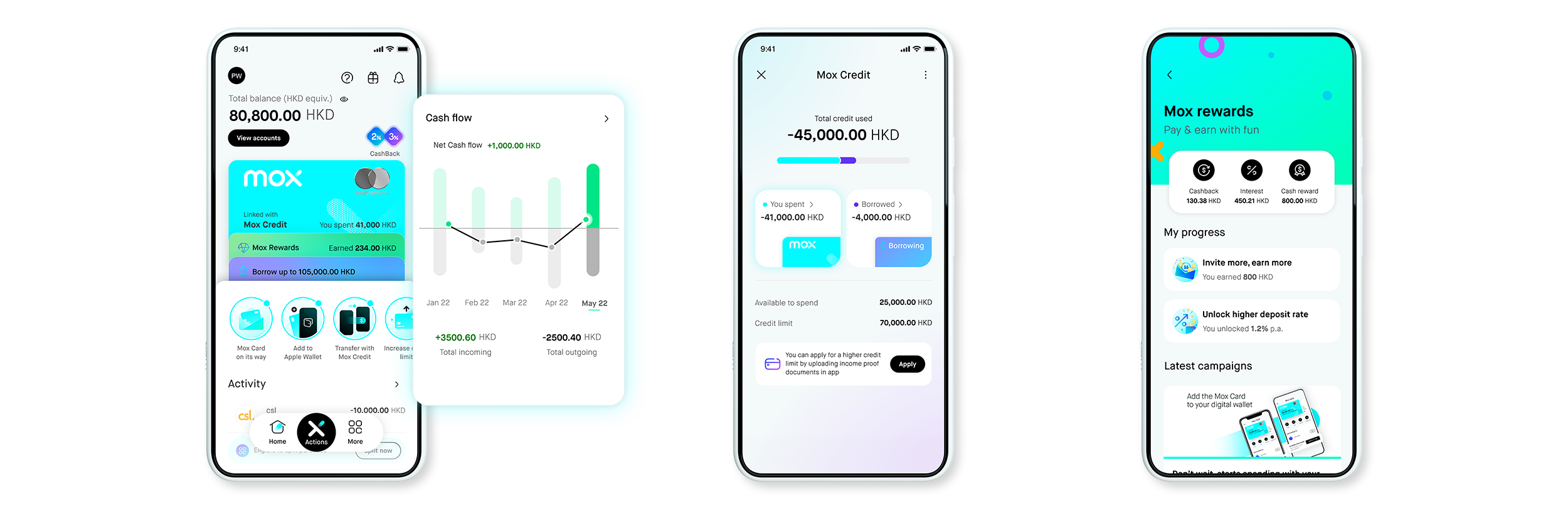

A new app interface brings user experience to new heights

The Mox app is already well-regarded for balancing simplicity, attractiveness and convenience in a single user interface. It results from a solid foundation design language system Mox built over the years. The same system helps Mox deliver consistent, high-quality experiences across all our products and services.

Mox is now pushing its boundaries even further with a new app interface. New features include:

- An innovative "Smart Swipe" and "Dedicated Hubs" create an engaging and fluid information structure, while also providing customers with a summary of vital information at a glance;

- A new “Mox Credit” section offers an intuitive look at credit and instalment information;

- A new “Mox Rewards” section provides a single location for customers to conveniently track their earning progress and stay updated with the latest campaigns;

- The enhanced dashboard enables customers to directly access account summaries and tools to monitor their spending and manage their finances more efficiently.

Mox is recognised globally and achieved remarkable results during its first three years

With 500,000 customers, Mox gained global recognition by receiving several renowned awards, including:

- Forbes World’s Best Banks 2023 – We were the only Hong Kong-headquartered bank and virtual bank on the list;

- Best Digital-only Bank at The Asian Banker Hong Kong Awards 2023;

- Fifth among the top 10 digital banks globally at the World Digital Bank Awards 2023 by The Digital Banker;

- Won 70 awards around the world.

In Hong Kong, according to TransUnion’s Market Insights and Intelligence Dashboard, Mox has become the seventh-largest credit card book size among all banks within two years of Mox Credit launch. Mox maintains its leading position among virtual banks. It continued its number-one streak for virtual banking apps in Hong Kong at the Apple App Store⁷ and consistently has the best Net Promoter Score (NPS) among all virtual banks in Hong Kong⁸.

In terms of performance, comparing the first six months of 2023 with the same period in 2022, Mox recorded:

- More than three times YoY growth in revenue;

- More than doubled our total customer loans and advances;

- Almost doubled in deposits;

- 2.2 million successful Mox Card transactions processed per month in the first six months of 2023.

While Mox continues to grow, it has consistently improved operational efficiency by lowering cost-to-serve per customer by more than half compared to the 2021 average. In addition to delivering this efficiency, Mox is also readying more innovative services for our customers that will be available soon. Stay tuned!

¹Compared against 15 banks in Hong Kong with an unlimited cash rebate credit card as published on the bank’s official website as of 7 September 2023.

²Clause 8 of Schedule 1 (Terms and Conditions for Accounts and Card Management) to the General Terms and Conditions applies (which can be found in the Mox app and/or on our website).

³From 4 May 2021, earn unlimited CashBack calculated at 1% of the eligible transaction amount made with Mox Credit.

⁴From 26 September 2023, earn unlimited CashBack calculated at 2% on the amount of the eligible transaction made with Mox Credit, if you have an eligible balance of at least HKD75,000 in your savings accounts with Mox (excluding any balances held in your Time Deposit Account(s)) at the time you make the relevant transaction.

⁵From 26 September 2023, earn unlimited CashBack calculated at 3% on the eligible transaction amount made with Mox Credit at ‘supermarkets and grocery stores’, as classified by MasterCard Asia/Pacific (Hong Kong) Limited).

⁶From 26 September to 31 December 2023, earn up to HKD600 CashBack calculated at 3% on the eligible transaction made with Mox Credit at selected CashBack Merchants.

⁷As of 27 September 2023.

⁸Based on the aggregate results of three surveys conducted every six months from January 2022 to June 2023 by Human8 to compare Net Promoter Scores among all virtual banks plus four main incumbent banks in Hong Kong.