Mox Credit Card¹ All in One

One card. Every reward. Every moment.

Why juggle multiple cards just to earn miles here, cashback there, or to figure out which one to use at home or abroad?

Meet the Mox Credit Card¹. One card gives you the flexibility to switch between Asia Miles and Unlimited CashBack²˙³˙⁴ whenever you like – all with powerful security and instant spending controls. Just one card to keep life (and rewards) wonderfully simple.

Earn Asia Miles your way – from just HKD4 = 1 Asia Mile²

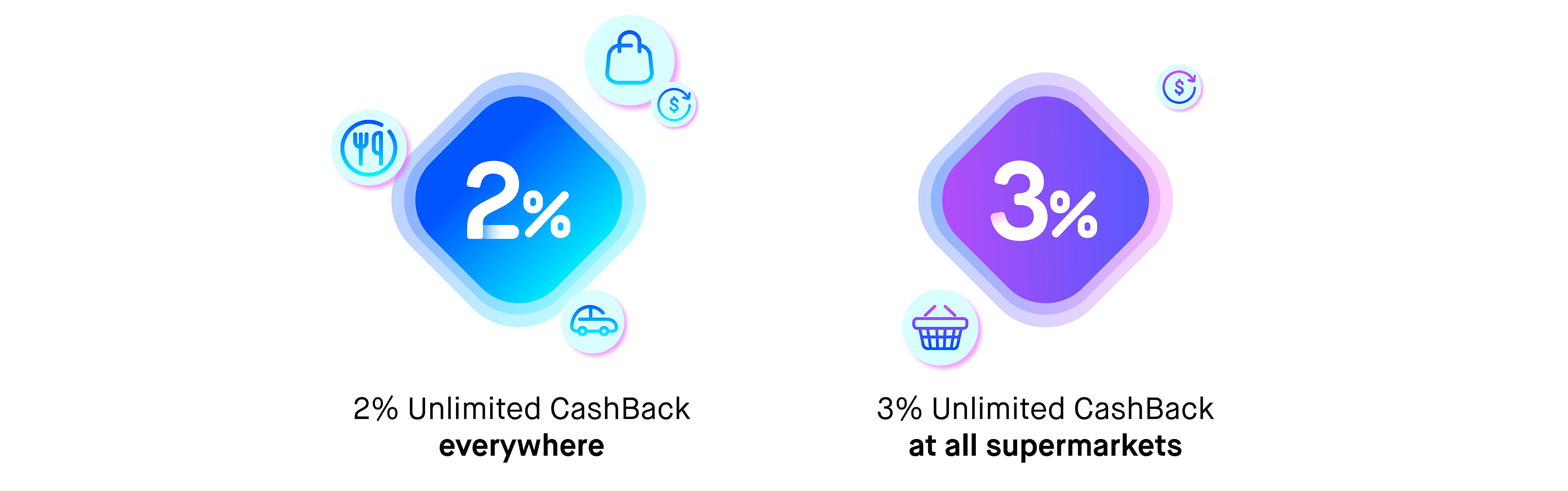

Prefer CashBack? Go unlimited – up to 2% everywhere you spend

Up to 2% Unlimited CashBack everywhere:

From dining, shopping, to travel and transport, earn 2% Unlimited CashBack on all your spend when you keep HKD250,000 eligible balance in your Mox Account (excluding Time Deposits).

*You can still earn 1% Unlimited CashBack even if your total balance dips below the above amount.

3% Unlimited CashBack at all supermarkets⁵:

Earn 3% Unlimited CashBack at major supermarkets in Hong Kong – perfect for topping up groceries, or stocking up for the week. No category limits, no confusing math, just pure rewards on everyday living.

Switch anytime. Earn your way with no caps. All from the same card.

Spend smart, earn well, save more – and unlock unlimited possibilities

Good at spending? Be great at saving too – that’s how you unlock more and more possibilities. By keeping an eligible balance of HKD250,000 or above in your Mox Account, you can enjoy 2% Unlimited CashBack on every purchase – no caps, no limits. Every dollar you spend earns you more, while your savings continue to grow with daily interest, paid daily, helping your wealth build faster so you can achieve even more.

Credit + Debit – One Mox Card does it all

Use the same Mox Card for both Mox Credit and your Mox Account (debit) – no extra cards to carry, ever.

Your all-rounder card:

- Physical card

- Digital card

- Apple Pay and Google Pay

- ATM card

- Numberless card design for next-level privacy and security

One card for everything you do.

Powerful flexibility – Transfer with FPS via credit

Mox is the first digital bank in Hong Kong to let you transfer money using FPS with your credit line. Send money to friends, pay rent, settle bills or shop online from small business – then enjoy up to 56 days interest-free before you pay it back.

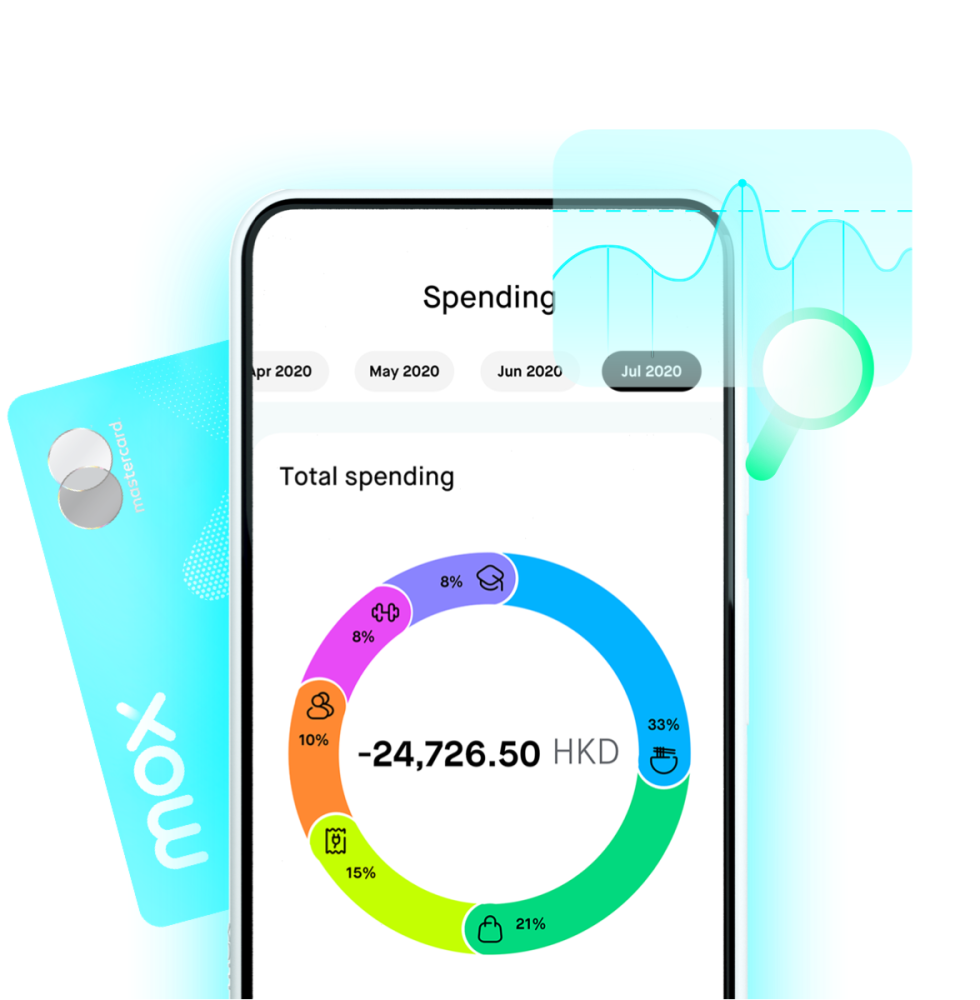

Plus, with automatic spending categorisation, you’ll see exactly where your money goes, all in one clean view.

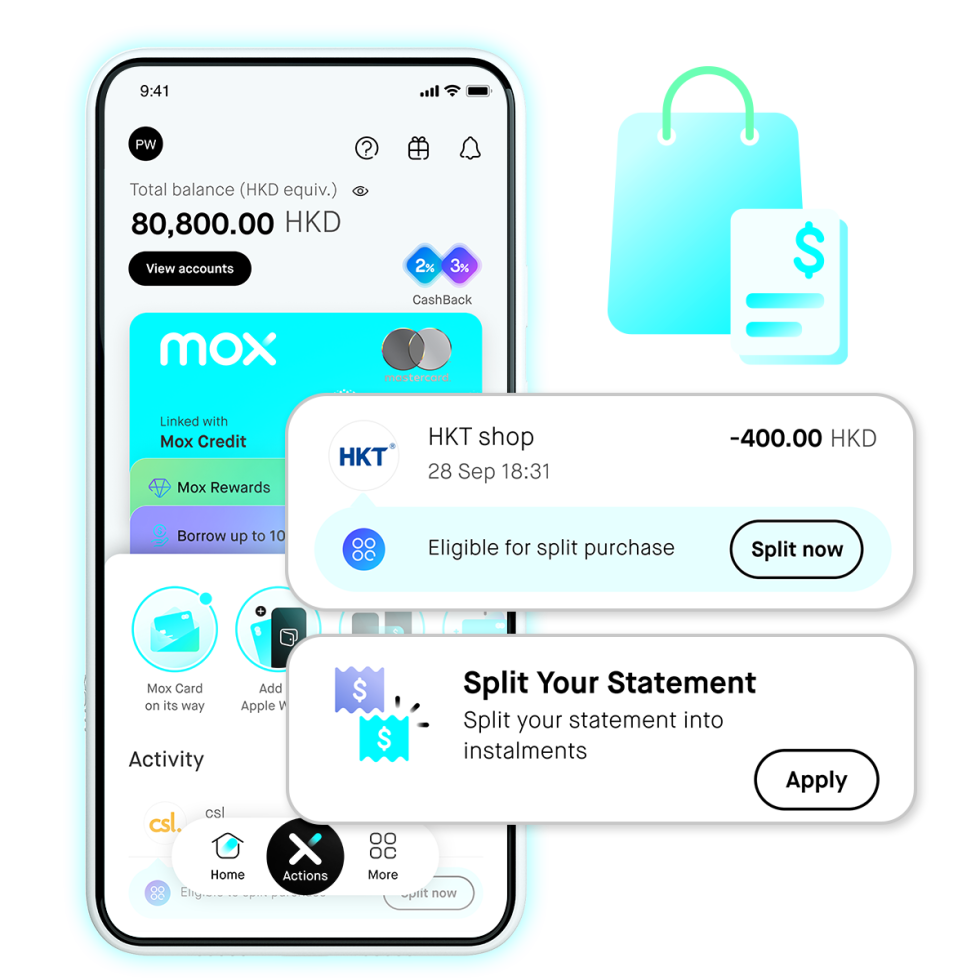

Want to split it? Easy.

Whether it’s one big purchase or your whole monthly statement, Split Purchase or Split Your Statement helps you spread costs your way.

- Pick a payoff time frame from 3 to 60 months

- See a transparent APR that updates in real time in the Mox app

- Split any eligible transaction(s) of HKD400+

- Or split your statement of HKD2,000+ up to 3 days before the due date

Flexibility, without the fine-print fear.

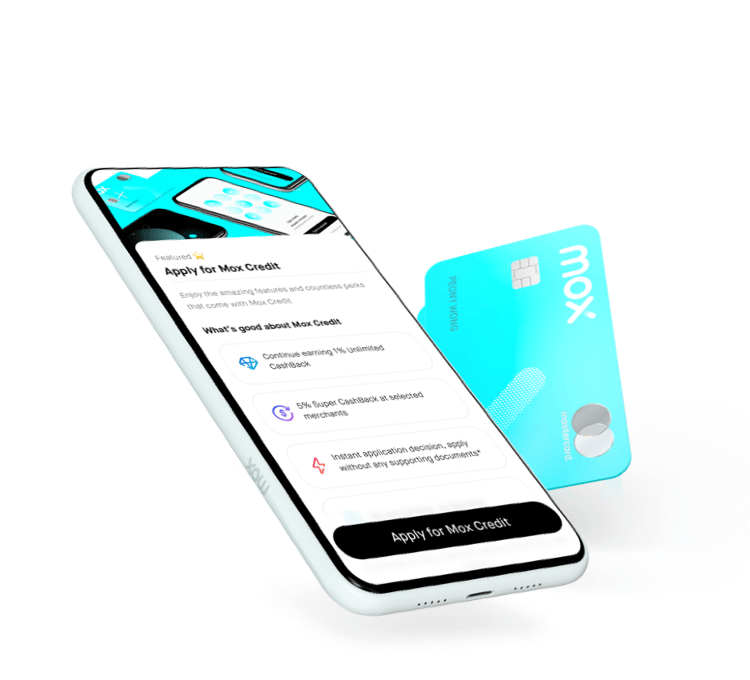

Apply now. No annual fee!

Your Mox Credit Card application takes only minutes to apply:

- Just your HKID Card

- Instant application decision, instant spending

- Simple document submission process (if required)

- Your physical Mox Card will be on its way shortly after

More than a credit card! Enjoy other great banking services with Mox Credit

Apply for Mox Credit Card

Plan Your Mox Credit Card Repayments

A smarter way to calculate and time your repayments

¹Please refer to the Mox Credit Schedule (also referred to as ‘Schedule 3 to the General Terms and Conditions’) and the Mox Credit Key Facts Statements for further details.

Friendly reminder: You can only apply for Mox Credit Card once your Mox Account has been successfully opened. In some circumstances, we may require you to provide supporting documents by a simple submission process when you apply for Mox Credit Card. The approval time for Mox Credit Card is subject to a customer’s individual circumstances.

²Please refer to the Rewards for Cards Schedule for further details. From 1 December 2025, when you make an eligible Mox Credit Card transaction, if you have (a) an Eligible Balance for Card Rewards of HKD250,000 or more; and/or (b) completed an Eligible Payroll Transaction of HKD25,000 or more (each an “Unlocking Criteria”) you may earn HKD4 = 1 Asia Mile on the amount of the eligible Mox Credit Card transaction. From 1 December 2025 to 31 March 2026 (both dates inclusive), if you have not satisfied an Unlocking Criteria at the time you make an eligible Mox Credit Card transaction, you may earn HKD8 = 1 Asia Mile on the amount of the eligible Mox Credit Card transaction. From 1 April 2026, if you have not satisfied an Unlocking Criteria at the time you make an eligible Mox Credit Card transaction, you may earn HKD10 = 1 Asia Mile on the amount of eligible Mox Credit Card transaction.

“Eligible Balance for Card Rewards” means the ‘available cash balance’, any ‘cash on hold’ and any ‘cash on hold for fund(s)’ in your savings accounts with Mox. For the avoidance of doubt, any ‘cash on hold from unsettled cash’ in your Mox Invest Account or balances in your Time Deposit Account(s) will not constitute ‘Eligible Balance for Card Rewards’.

“Eligible Payroll Transaction” means a transaction where your employer pays your salary into your Mox Account via FPS, and the transaction is displayed as ‘Salary’ in the Mox app. For the avoidance of doubt, standing instructions or other local electronic transfers are not considered ‘Eligible Payroll Transactions’. You will be eligible to receive HKD4 = 1 Asia Miles during the period beginning on and from the day you complete the Eligible Payroll Transaction and ending on the last day of the next calendar month.

³Please refer to the Rewards for Cards Schedule for further details. From 1 December 2025, when you make an eligible Mox Credit Card transaction, if you have (a) an Eligible Balance for Card Rewards of HKD250,000 or more, or (b) completed an Eligible Payroll Transaction of HKD25,000 or more, you may earn unlimited 2% CashBack on the amount of the eligible Mox Credit Card transaction. If you have an Eligible Balance for Card Rewards of below HKD250,000 or have not made an Eligible Payroll Transaction at the time you make an eligible Mox Credit Card transaction, you may earn unlimited 1% CashBack on the amount of eligible Mox Credit Card transaction. “Eligible Balance for Card Rewards” means the ‘available cash balance’, any ‘cash on hold’ and any ‘cash on hold for fund(s)’ in your savings accounts with Mox. For the avoidance of doubt, any ‘cash on hold from unsettled cash’ in your Mox Invest Account or balances in your Time Deposit Account(s) will not constitute ‘Eligible Balance for Card Rewards’. “Eligible Payroll Transaction” means a transaction where your employer pays your salary into your Mox Account via FPS, and the transaction is displayed as ‘Salary’ in the Mox app. For the avoidance of doubt, standing instructions or other local electronic transfers are not considered ‘Eligible Payroll Transactions’. You will be eligible to receive 2% CashBack during the period beginning on and from the day you complete the Eligible Payroll Transaction and ending on the last day of the next calendar month.

⁴If you have an Eligible Balance for Card Rewards of below HKD250,000 at the time you switch your Spending Rewards, a Spending Rewards Switching Fee of HKD50 will be charged. Please refer to the Definitions Schedule for the definition of ‘Eligible Balance for Card Rewards’.

⁵FX Fees refer to the Foreign Exchange Handling Fee and the Cross-Border Access Fee. Asia Miles have to be chosen as your Spending Rewards Scheme. 0% Foreign Currencies and Overseas Merchant Spending Fees Promotion Terms and Conditions apply.

⁶Earn unlimited 3% CashBack on the amount of eligible Mox Credit Card transaction made at supermarkets and grocery stores, each as classified by Mastercard Asia/Pacific (Hong Kong) Limited.

⁷Whether you can transfer money using your Mox Credit depends on multiple factors. You may be restricted from using Mox Credit to make transfers even if there is available balance in your Mox Credit account.

⁸General Terms and Conditions (in particular, see Part A: Split Purchase of Schedule 3) and the Split Purchase Key Facts Statement apply. Refer to legal terms and conditions for more details. The fees for Split Purchase will be reviewed from time to time. Each monthly instalment for a Split Purchase is charged to Mox Credit and will show on your Mox Credit statement. Please pay your Mox Credit statement balance in full on or before its due date to avoid finance charges (interest).

⁹The APR is calculated using method specified in relevant guidelines issued by the Hong Kong Associations of Banks. The APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualised rate.

¹⁰Only certain types of Mox Credit transactions and amounts of Mox Credit statement balances are eligible for Split Purchase, as determined by us in our absolute discretion. The examples of transactions and amounts of Mox Credit statement balances that are ineligible for Split Purchase are listed in General Terms and Conditions (in particular, see Part A: Split Purchase of Schedule 3) – clause 8(d).