Exclusive for QBE Staff, Family & Friends: Earn big with Cash Rewards or Asia Miles by switching your Payroll Account to Mox

The easiest way to earn Asia Miles is here! ✈️🧳

At Mox, we give you the perks you deserve, so payday is a pleasure. And for QBE Staff, Family & Friends, the celebration is even bigger! 🥳

Switch your payroll to Mox and save, to earn up to HKD1,550 Cash Rewards or 15,500 Asia Miles. Plus, you get a chance to earn 50,000 miles – ✈️ enough to redeem two round trips to Japan, or even a Paris trip for some shopping!

💰Reward 1: Up to HKD1,550 Cash Rewards OR 15,500 Asia Miles.

The more you make, the more you take! The reward amount is based on your average monthly salary in your Mox Account:

| Average monthly salary (HKD) | Rewards |

|---|---|

| 25,000 - below 50,000 | HKD 800 Cash Rewards or 8,000 Asia Miles |

| 50,000 or above | HKD 1,550 Cash Rewards or 15,500 Asia Miles |

💰Reward 2 (QBE Exclusive): A chance to win an additional 50,000 Asia Miles!

And that’s not all! When you successfully join the above payroll promotion, you’ll automatically get a chance to win an additional 50,000 Asia Miles – enough for 2 round-trip tickets to Japan or even a Paris trip for some shopping!

What are you waiting for? Register today and start earning those rewards!

Lucky Draw Result Announcement

Thank you for your participation! QBE Exclusive Asia Miles Lucky Draw has taken place. Please click here to view the winner list.

Mox will notify the winner by email. Miles will be credited to the winner’s registered Cathay Membership Account on or before 31 May 2025.

Registration must be completed on this website by 31 January 2025.

How to Claim Your Rewards After Registering?

Step 1: Fund in by changing your payroll to Mox or by transferring from another bank

Transfer HKD25,000 or above to your Mox Account for four consecutive months between January 2025 and April 2025 through one of the three methods below²:

- Fill in the Payroll Transfer Request Form and notify your Human Resources department of the payroll Account change¹, OR

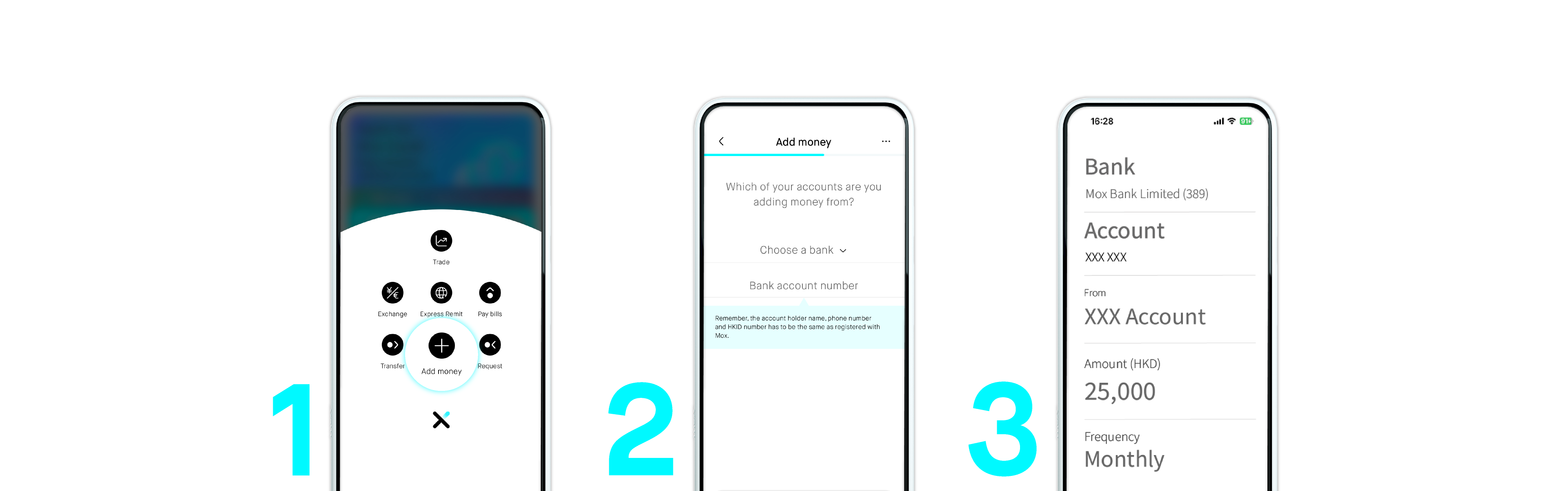

- Set up a recurring monthly transfer of at least HKD25,000 from another bank Account to your Mox Account using the “Add Money” function in the Mox app, OR,

- Set up a standing instruction of at least HKD25,000 from your other bank’s app to your Mox Account.

- Log in to your other banks’ Mobile Banking site and select “Transfer” or or “Standing Instructions”

- Enter all the needed info, including the details below:

• Bank ID: 389

• Bank: Mox Bank Limited

• Your Mox Account number and Account holder’s name - Enter an amount of at least HKD25,000 then select “Recurring Transfer”, enter the start date and choose “Monthly” for frequency.

- Make sure to label this transfer “MOXPAYROLL” and you’re all set!

*The above SI setup is for reference only and may vary among different banks. Some banks may not support setting up SI online and the final set-up method is subject to differences in other banks’ processes

Step 2: Maintain Your Balance

Ensure your Mox HKD savings Account (excluding Time Deposits) has a balance of at least HKD100,000 on 30 April 2025.

That’s it!

Share the wealth! Tell your friends about this amazing offer and earn together!

FAQ

Successful registrants will receive email confirmation from Mox by 7 February 2025.

The ‘Add money’ feature allows you to ‘pull’ money into your account(s) with Mox from your account(s) with other banks for free, without leaving the Mox app.

The list of banks that we support for this feature includes the following banks, and we’re working to expand this list:

- Standard Chartered Bank (Hong Kong) Limited

- Bank of China (Hong Kong) Limited

- China CITIC Bank International Limited

- China Construction Bank (Asia) Corporation Limited

- Citibank (Hong Kong) Limited

- DBS Bank (Hong Kong) Limited

- Hang Seng Bank Limited

- Livi Bank Limited

- Nanyang Commercial Bank, Limited

- The Bank of East Asia, Limited

- The Hongkong and Shanghai Banking Corporation Limited

- Welab Bank Limited

- ZA Bank Limited

There is no limit for each ‘Add money’ transaction with the following banks:

- Standard Chartered Bank (Hong Kong) Limited

- Citibank (Hong Kong) Limited

- Livi Bank Limited

- Welab Bank Limited

- ZA Bank Limited

- China CITIC Bank International Limited

There is a HKD10,000 /CNY10,000 limit for each ‘Add money’ transaction* with the following banks:

- Bank of China (Hong Kong) Limited

- DBS Bank (Hong Kong) Limited

- Hang Seng Bank Limited

- The Hongkong and Shanghai Banking Corporation Limited

There is a HKD2,000 / CNY2000 limit for each ‘Add money’ transaction* with the following banks:

- China Construction Bank (Asia) Corporation Limited

- Nanyang Commercial Bank, Limited

- The Bank of East Asia, Limited

*Don’t worry, if the amount you want to bring into Mox exceeds the transaction limit, you can make as many ‘Add money’ transactions as you need each day.